Weekly Market Recap (Oct 28-Nov 1): Momentum Slows Down As US Election and Fed Meeting Approach - Are Bears Back In Charge?

Everything you need to know about last week's markets performance and what to expect next.

Dear subscribers,

Welcome to My Weekly Stock, where we blend in-depth market analysis with proven momentum-based trading strategies. My mission? Help you navigate the financial markets with unbiased, data-driven insights you can act on!

Every week, I spend hours curating this market recap, producing insightful analyses with clear visuals and a structured layout so you can easily find what you need, week after week. And because it's easy to get swayed by personal bias, I like to let the data do most of the talking.

Remember to upgrade your subscription to access all my trading and investing portfolios, and see how I protect my gains in these turbulent times!

Let’s get started!

SUMMARY

Here are this week's highlights and what to look out for next:

1. The markets were negative this week, with the S&P 500 down -1.4%, the Nasdaq -1.5%, and the Dow Jones -0.2%. Communication Serv. (+1.7%) and Financials (+0%) were the best-performing sectors.

2. The S&P 500's long-term trend is positive, while the short-term trend has turned negative. 5,775 is the next resistance, while 5,700 is support.

3. The Q3 earnings season is well under way and 349 companies from the S&P 500 index have released their Q3 results, with 77% beating estimates. Earnings are expected to be up 8% in Q3 2024 and 10% in 2024.

4. Market sentiment is at the "Neutral" level (49) as measured by CNN’s Fear & Greed indicator, while VIX is at a high value of 22.

5. Earnings reports from Qualcomm and Palantir, the US election, and the FOMC are scheduled for next week.

My take:

The markets started the week sideways, awaiting key tech earnings. However, after disappointing reports from Microsoft and, to some extent, Meta, the market ultimately broke to the downside. While we saw an attempt at a bounce on Friday, it wasn’t enough to avoid a second consecutive weekly loss.

Next week will likely be challenging to navigate, with the US presidential election and the Fed meeting on deck. Predicting how the market will react to them is nearly impossible. In my view, the best approach is to defer to the trend and be ready to respond. In the short term, bears have regained control, with the S&P 500 now trading below its 21-day exponential moving average, a critical short-term trend line. For the momentum to shift back positive, we’ll need to reclaim a resistance level, starting with 5,775, the highs from Thursday and Friday. Until then, trade cautiously as we enter what’s likely to be the most complex week of the year.

PERFORMANCE RECAP

1. S&P 500 Sector Performance

Over the week, 2 of the 11 S&P 500 sectors have achieved gains. Communication Services led the way, rising by 1.7%. By contrast, Real Estate was the weakest, falling by -3%.

Year-to-date, all the sectors have seen positive results. Communication Services has been the most successful sector, with a 27% gain. On the other hand, Energy has been trailing behind.

2. S&P 500 Top & Worst Performers

In the last 5 trading days, 35% of the stocks in the S&P 500 index rose in value.

The best-performing stocks were:

Paycom Software Inc (PAYC, 28%)

Garmin Ltd (GRMN, 22%)

Waters Corp (WAT, 19%)

Meanwhile, the worst-performing stocks were:

Estee Lauder Cos., Inc (EL, -24%)

Huntington Ingalls Industries Inc (HII, -25%)

Qorvo Inc (QRVO, -27%)

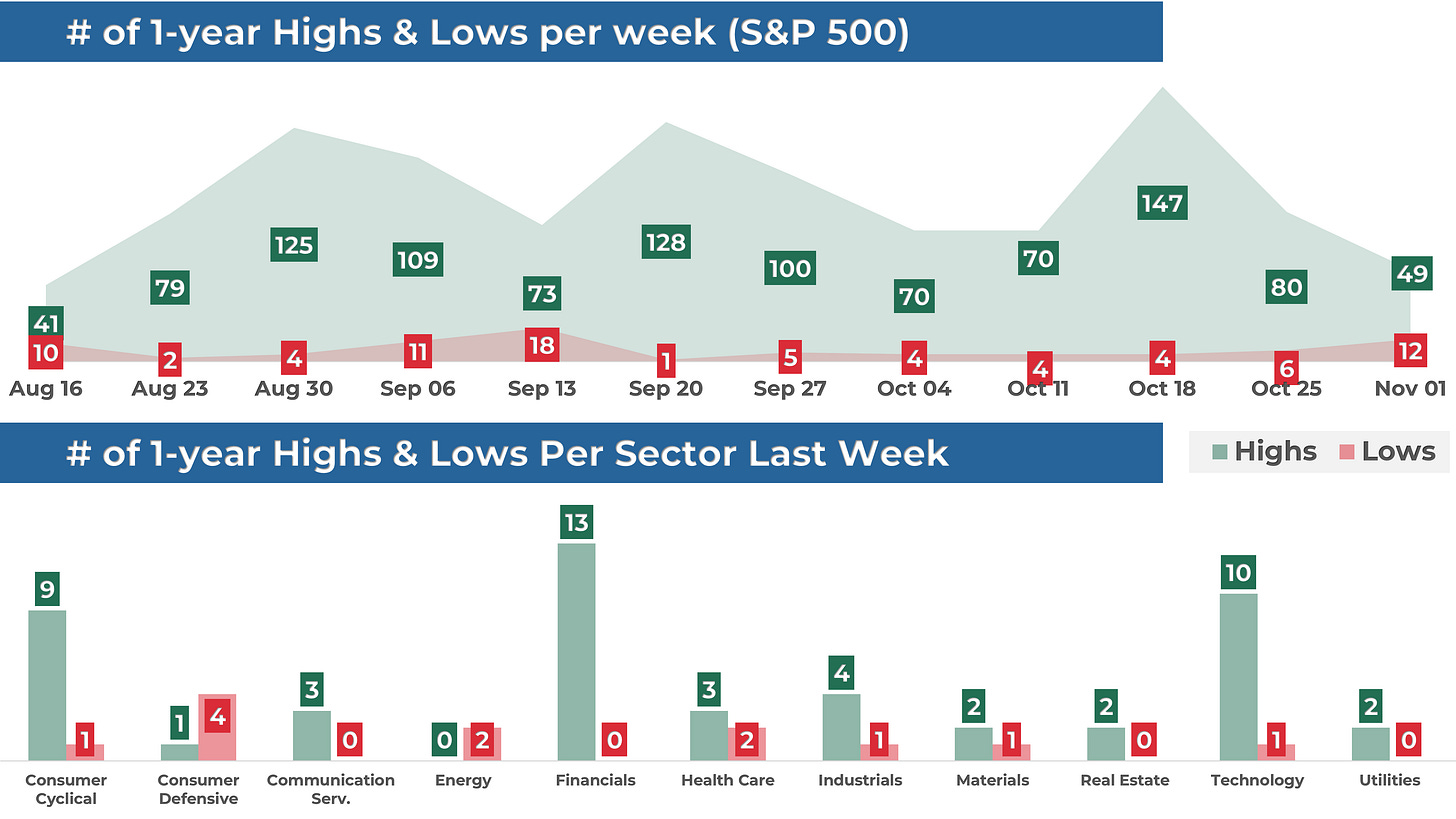

In addition, 49 stocks within the S&P 500 reached a new 52-week high, while 12 set new lows. Most of the highs this week came from the Financial sector.

MARKET TRENDS & MOMENTUM

1. S&P 500 Long-Term Trend

The long-term trend for the S&P 500 is positive. I base this evaluation on the 9 and 30-week exponential moving averages (EMAs). To determine if the trend is strongly positive, I look for the following conditions (the 1st is the most important):

9-week EMA is above the 30-week EMA: 🟢

Price is trading above the 9-week EMA: 🟡

Price is trading above the 30-week EMA: 🟢

The 9-week EMA trend line is rising: 🟢

The 30-week EMA trend line is rising: 🟢

I also use the MACD as an additional tool to detect trend changes. The MACD line is around its signal line, a neutral indication for the index.

2. S&P 500 Technical Analysis

Healthy bull markets typically see the index set several new highs, broad market participation, and ascending trend lines. That's why I've created a four-part scorecard – a straightforward tool to give us a comprehensive view of these essential health indicators.

Momentum: The index is up 1% over the past month, 10% in the last three months, and is trading 3% away from its 52-week high.

Breadth: Market participation remains healthy in the long term, as 69% of S&P 500 stocks are trading above their 200-day moving average (SMA). Meanwhile, 34% of the stocks are trading above their 20-day SMA, down from 41% the previous week. A reading above 80% or below 20% typically indicates an overextended trend.

Trends: The trend on the 1-day and 4-houchart is negative, with the index trading below its 2-period exponential moving average.

Key levels: The next resistance level is 5,775. On the other hand, the next support area is at 5,700.

3. Momentum Analysis of the Week

This week's momentum analysis is about seasonality, as we just started the month of November. Since 1964, the S&P500 has been up 68% of the time in November, averaging a 1.4% return.

EARNINGS RECAP

1. Q3 and Full Year 2024 Expected EPS & Revenue Growth

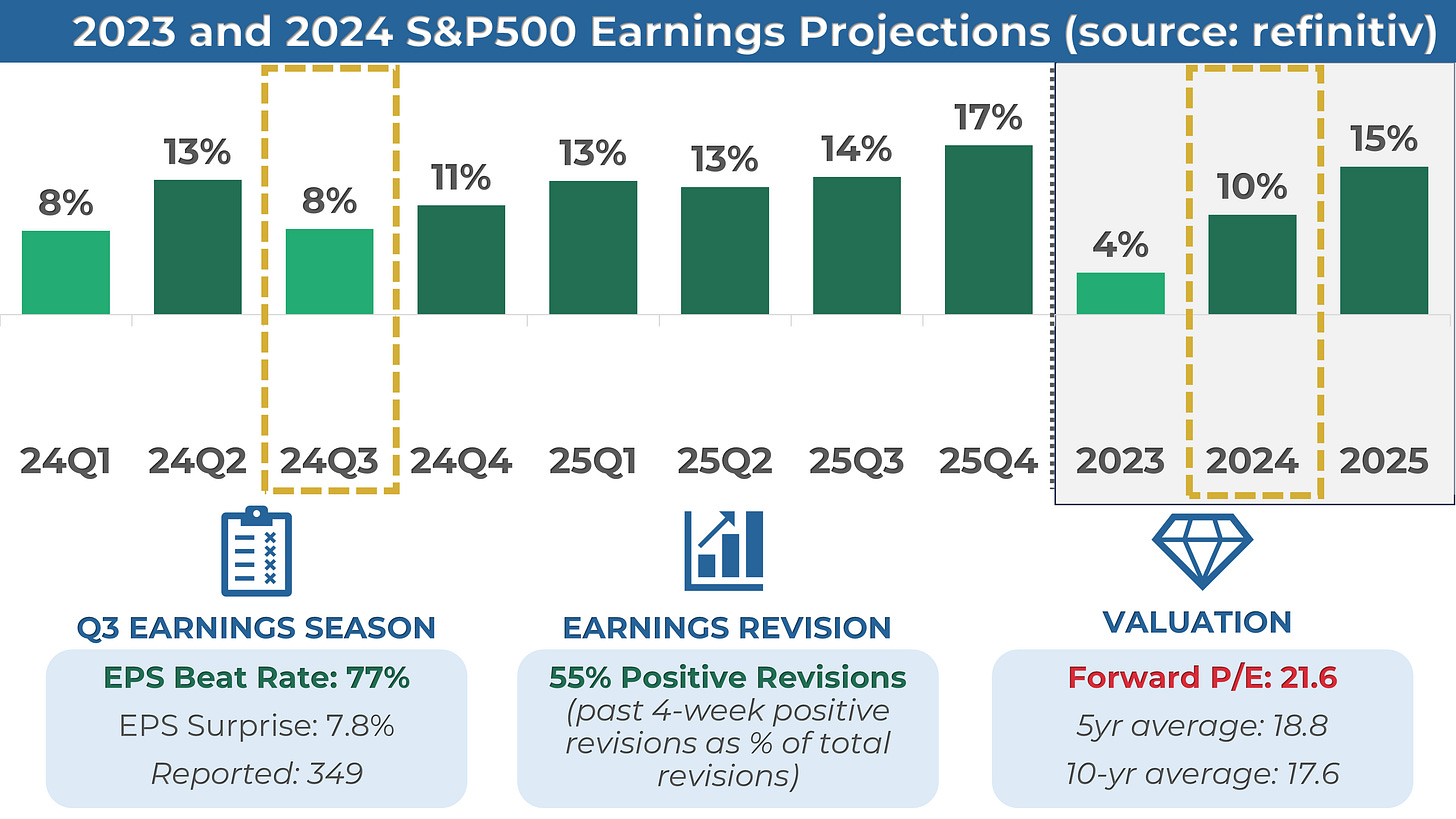

Q3 2024 earnings for the S&P 500 are expected to be up 8%. Excluding the energy sector, the figure is +11%.

Earnings are projected to grow by 10% in 2024, slightly higher than the 9% growth seen on average over the last decade. In the past four weeks, 55% of earnings revisions made by analysts were to increase their outlook.

The forward 4-quarter P/E ratio is 21.6, higher than the average over the past five and ten years.

2. Q3 Earnings Season Summary

349 companies from the S&P 500 index have released their third-quarter earnings, with 77% posting higher EPS than expectations. This is slightly below with the previous four-quarter average of 79% and higher than the historical average of 67%.

MARKET SENTIMENT

Measures of investor sentiment can be helpful as they provide insight into the views and opinions of professional or individual investors. However, it's important to note that these measures are not perfect predictors of market movements. They should be combined with other indicators and analysis tools for a complete market picture.

1. AAII Sentiment Survey (Individual Investors)

The American Association of Individual Investors (AAII) conducts a weekly survey among its members to gauge their expectations for the stock market over the next six months. The results are published every Wednesday.

According to the most recent AAII survey, 40% of the respondents had a bullish outlook on the stock market, increasing by 2 points from the previous week.

2. BofA Bull & Bear Indicator (Institutional Investors)

The Bank of America Bull-Bear Indicator is a proprietary measure of investor sentiment developed by Bank of America. It is based on a survey of fund managers and institutional investors, and it tracks the percentage of respondents who are bullish, bearish, or neutral on the stock market. Results are published in the form of a score ranging from 0 (extremely bearish) to 10 (extremely bullish)

The latest reading available of the indicator was 6.2, a bullish sentiment reading.

3. CNN Fear & Greed Index (Technical)

The CNN Fear & Greed Index is a daily measure that analyzes seven market indicators to assess how emotions influence investors' decisions. The index is scored out of 100 and categorizes results into five stages: Extreme Fear, Fear, Neutral, Greed, and Extreme Greed.

The index closed at 49, or a “Neutral” level, down from 59 last Friday.

THE WEEK AHEAD

1. Economic Calendar

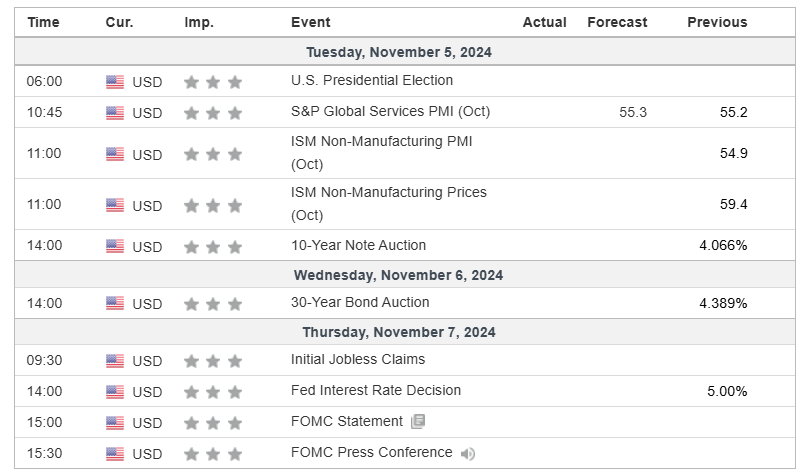

Another intense week is upon us, with the main event being obviously the U.S. presidential election. Additionally, the Federal Reserve is meeting this week and will issue its interest rate decision on Thursday.

2. Earnings Calendar

Earnings season continues next week, and 102 companies from the S&P 500, including Qualcomm and Palantir, are expected to release their quarterly results.

3. Next Week’s Earnings Watchlist

Below is my watchlist of stocks reporting week next week, along with several key indicators I like to review:

Stock Indicators:

Stock performance in the last 3 months.

RSI, where a reading of 70 indicates overbought status and a reading of 30 oversold.

PE ratio, where a reading below 25 indicates a "cheap" valuation and/or low growth expectations.

Stock Price Reactions to Earnings:

1-day Stock Return on Earnings is the stock performance on the earnings release date.

Implied volatility is the expected 1-day stock change after earnings are released, as assessed by the options markets.

Every week, I share my analysis of 1 stock reporting earnings in the coming days, focusing on implications for long-term investors. This week, I prepared an in-depth overview of Palantir ($PLTR). In this post, I break down key data points around Palantir’s fundamentals, stock returns, analyst ratings, and past earnings performance to help you make informed investment decisions. Check out the post and learn why I gave a “HOLD” rating to Palantir.

That’s a wrap for this week’s recap! I hope it helped you understand the market better.

If you enjoyed this post, you should explore the premium section: I provide my short-term trading and analysis of over 20 US large caps and share my long-term investing portfolios. Upgrade your subscription to unlock all the exclusive features and insights.

If you have any questions or feedback, please don't hesitate to email me or comment on this post. Your support helps me create high-quality content and is greatly appreciated!

Have a great week!

My Weekly Stock

DISCLAIMER

The information provided in this newsletter is for informational purposes only and should not be taken as financial advice. Any investments or decisions made based on the information provided in this newsletter are the reader's sole responsibility. We recommend that readers conduct their own research and consult a qualified financial professional before making investment decisions. The author does not assume any responsibility for any losses or damages arising from using the information provided in this newsletter.

With the SPY showing signs of weakening uptrends and the market struggling to hold momentum, I’m curious—how do you think the upcoming U.S. elections might impact this trend? Do you see any historical patterns around election periods that could give us insight into what might come next?