Dear subscribers,

Welcome back to My Weekly Stock, where we blend in-depth market analysis with proven momentum-based trading strategies. My mission? Help you navigate the financial markets with unbiased, data-driven insights you can act on.

This mid-week update is about my long-term portfolios, where I will share more about my investing approach, my holdings, and my performance.

THIS MONTH’S HIGHLIGHTS

My portfolios for long-term investing are based on 3 common principles: entry/exit based on the weekly chart, diversification, and compounding. Here are the key highlights for this month:

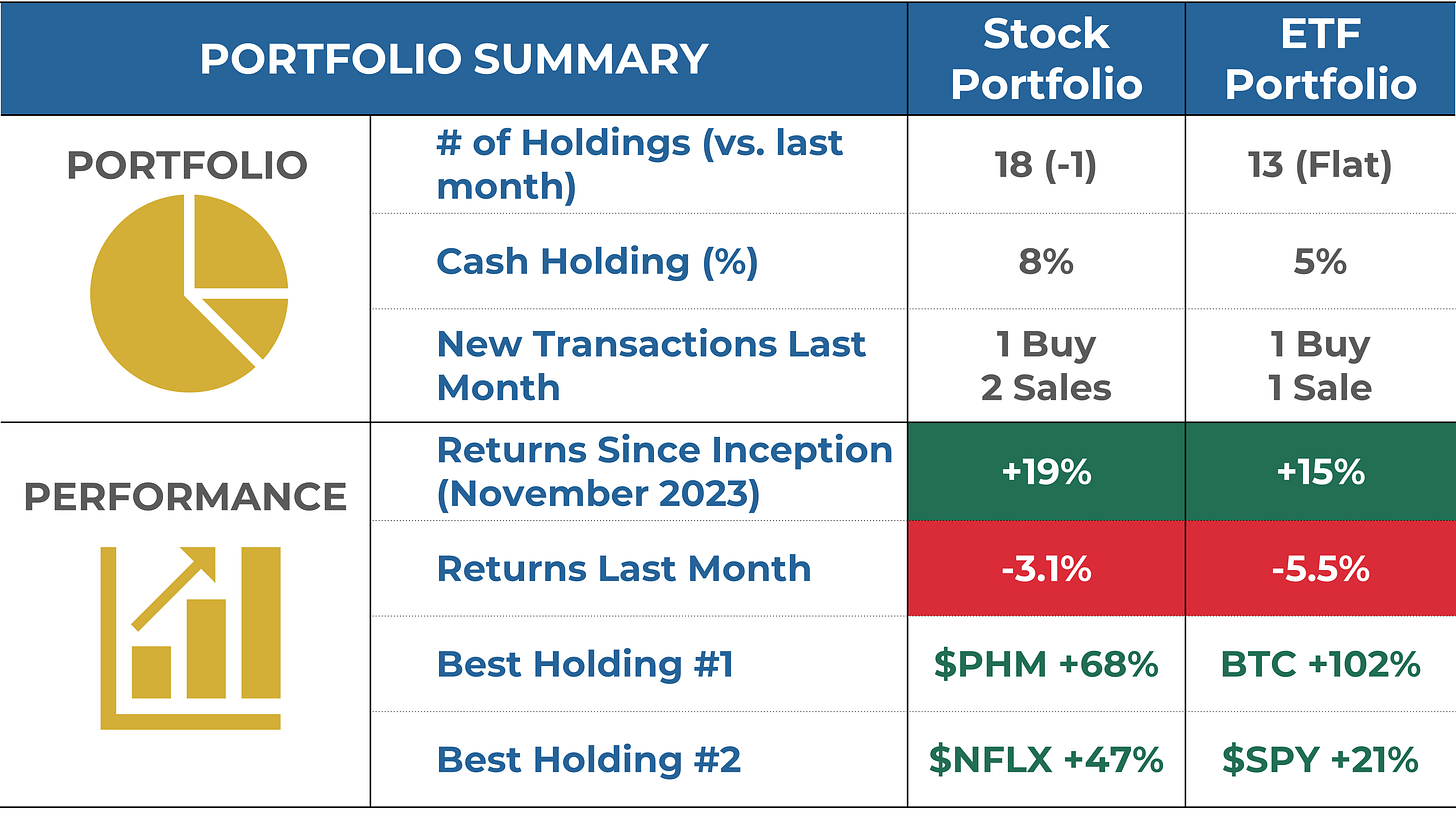

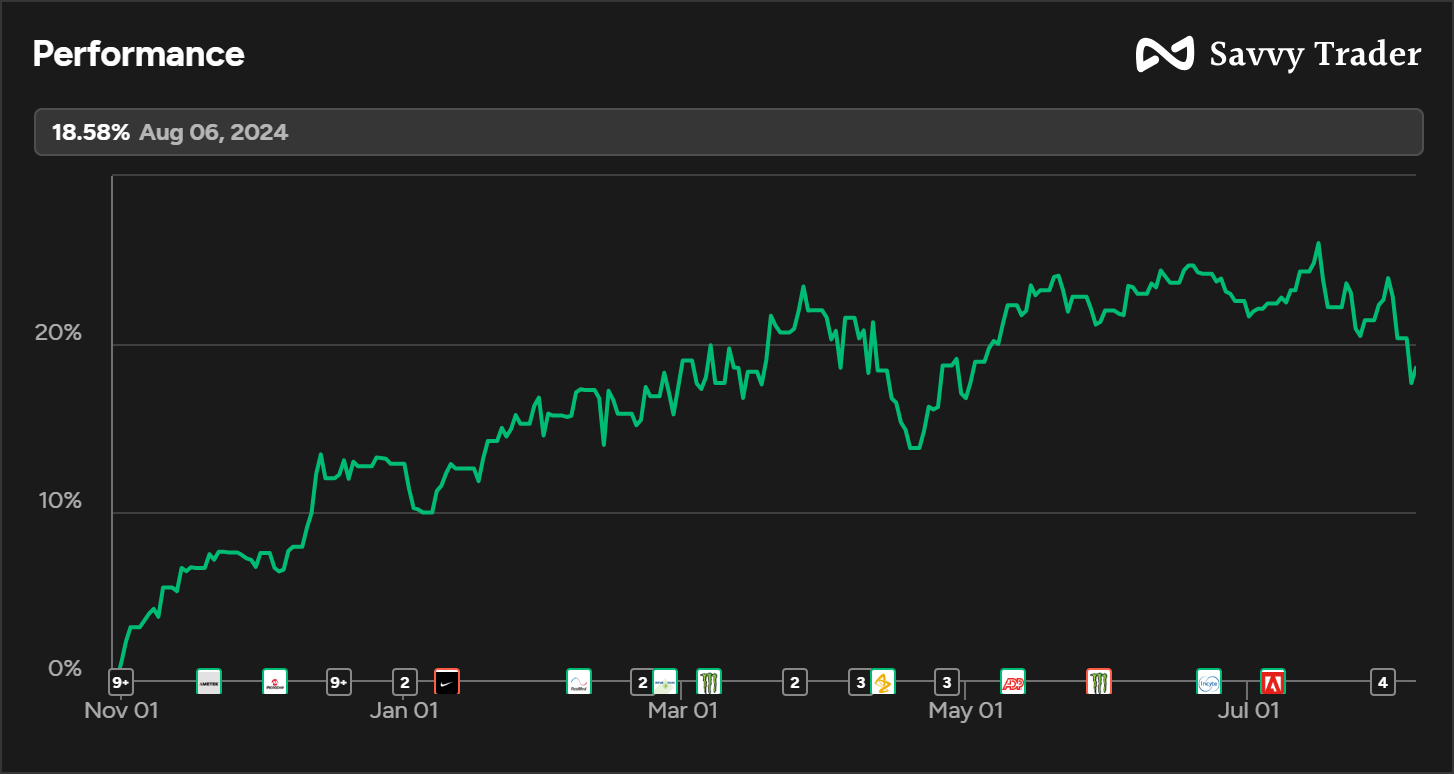

Performance: Since their inception in October 2023, the stock and ETF portfolios have returned 19% and 15% respectively.

Portfolio composition: I am almost entirely invested (92%+) and currently own 18 stocks and 13 ETFs.

Activity: last month, I made further adjutments to the portfolios, initiating 2 new positions and making 3 sales.

This Month’s Takeaways:

Both portfolios took a beating last month, particularly the macro portfolio, which suffered from the sell-off in Nasdaq and crypto. However, pullbacks, regardless of how scary they might look- and this Monday's looked scary- are no reason to panic, especially with long-term accounts. Most of my holdings are still well anchored in a positive long-term trend.

My priorities in the coming months will be to make adjustments by cutting disappointing holdings and looking for new investments with attractive setups. While not always easy, I like to see pullbacks as opportunities to strengthen my portfolios.

LONG-TERM STOCK PORTFOLIO

My Approach

I start the stock selection process by filtering stocks within the US markets through fundamental criteria. This method usually narrows my focus to approximately 30 stocks. To ensure these stocks continually meet my investment criteria and to adapt to evolving market conditions, I update my watchlist every 3 to 6 months. This disciplined approach helps maintain a relevant portfolio.

My investment approach is anchored in 3 fundamental screening criteria:

Growth: I target companies exhibiting over 10% Earnings Per Share (EPS) growth and more than 5% revenue growth

Margin: I focus on companies with a Return on Invested Capital (ROIC), Operating Margins, and Free Cash Flow (FCF) margins above 10%. These indicators reflect management's efficiency and attractive company's profitability.

Balance Sheet: I look for companies with a Debt-to-Equity ratio below 1 and a Current Ratio above 1, which suggests financial health and stability.

The essence of my portfolio strategy is to invest in growing companies with attractive margins and solid financial foundations. These traits closely align with the potential for long-term stock price appreciation.

Identifying such companies is crucial, but the timing of investments is equally important. To this end, I use the Exponential Moving Average (9 and 30) on weekly charts. The process helps me time my entries and exits and ultimately find setups with attractive risk-reward profiles.

I allocate around 5% of my portfolio to each investment, balancing risk management and potential returns. The holding period for these positions can extend from several months to years, assuming they sustain their positive momentum. This approach ensures that each investment has ample time to achieve its full value.

My Performance

I'm confident that my hybrid approach can produce substantial returns over time, and my back-testing has suggested so. Since its inception in November 2023, my portfolio has achieved a cumulative return of +19%. In the last month, the portfolio has returned -3.1%.

My Current Holdings

Here's an overview of my current stock portfolio: 92% is actively invested, with the remaining 8% kept in cash. The portfolio has 18 positions, and the best performers are PHM (+68%), NFLX (+47%), and AMAT (+38%).

Keep reading with a 7-day free trial

Subscribe to My Weekly Stock to keep reading this post and get 7 days of free access to the full post archives.