Welcome to my weekly tracker, where I share my trading performance since 2019. I am committed to transparency and honesty, and I will provide detailed insights into my performance in this article.

I believe that this level of transparency is essential for building trust with my readers and subscribers. I invite you to join me on this journey as I share my successes and challenges in the world of trading. So, without further ado, let's dive in and take a closer look at my performance over the past few years.

Last update: December 31st, 2023

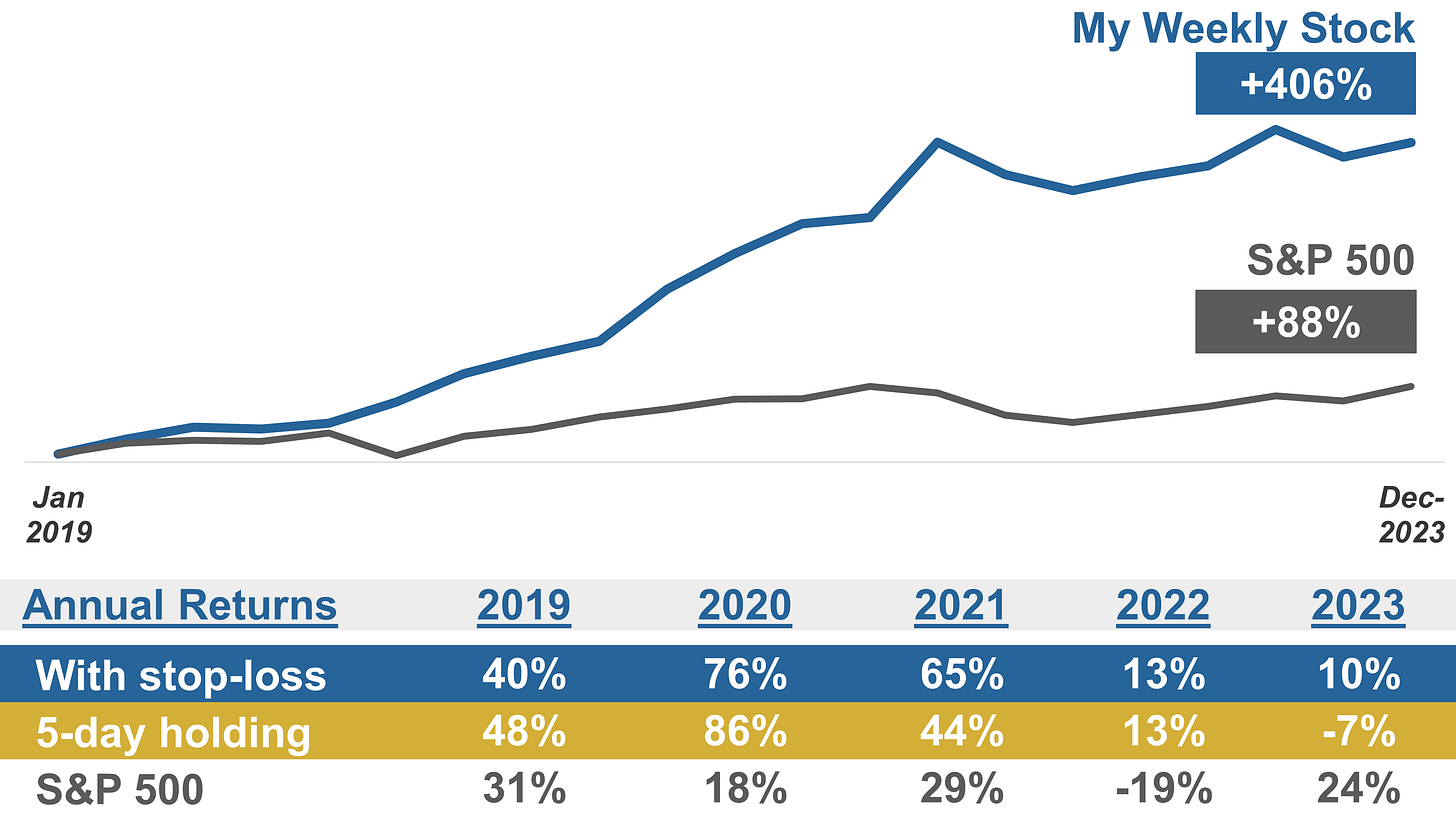

MY WEEKLY STOCK PERFORMANCE

Below is the cumulative performance of my weekly stock picks since 2019. For simplicity, I measure weekly performance based on an entry at the Monday open and an exit at the Friday close, excluding transaction fees and dividends.

I personally trade all my picks with a 2% stop-loss and 6% profit target. My performance based on these price targets better align better with my personal trading performance.

Cumulative and yearly performance assume weekly results are compounded.

The Max Drawdown is the maximum decline observed vs. the highest value of our portfolio during a specific year.

The Hit Rate is the number of weekly winners as a percentage of the total number of weeks.

Past performance does not guarantee future results.

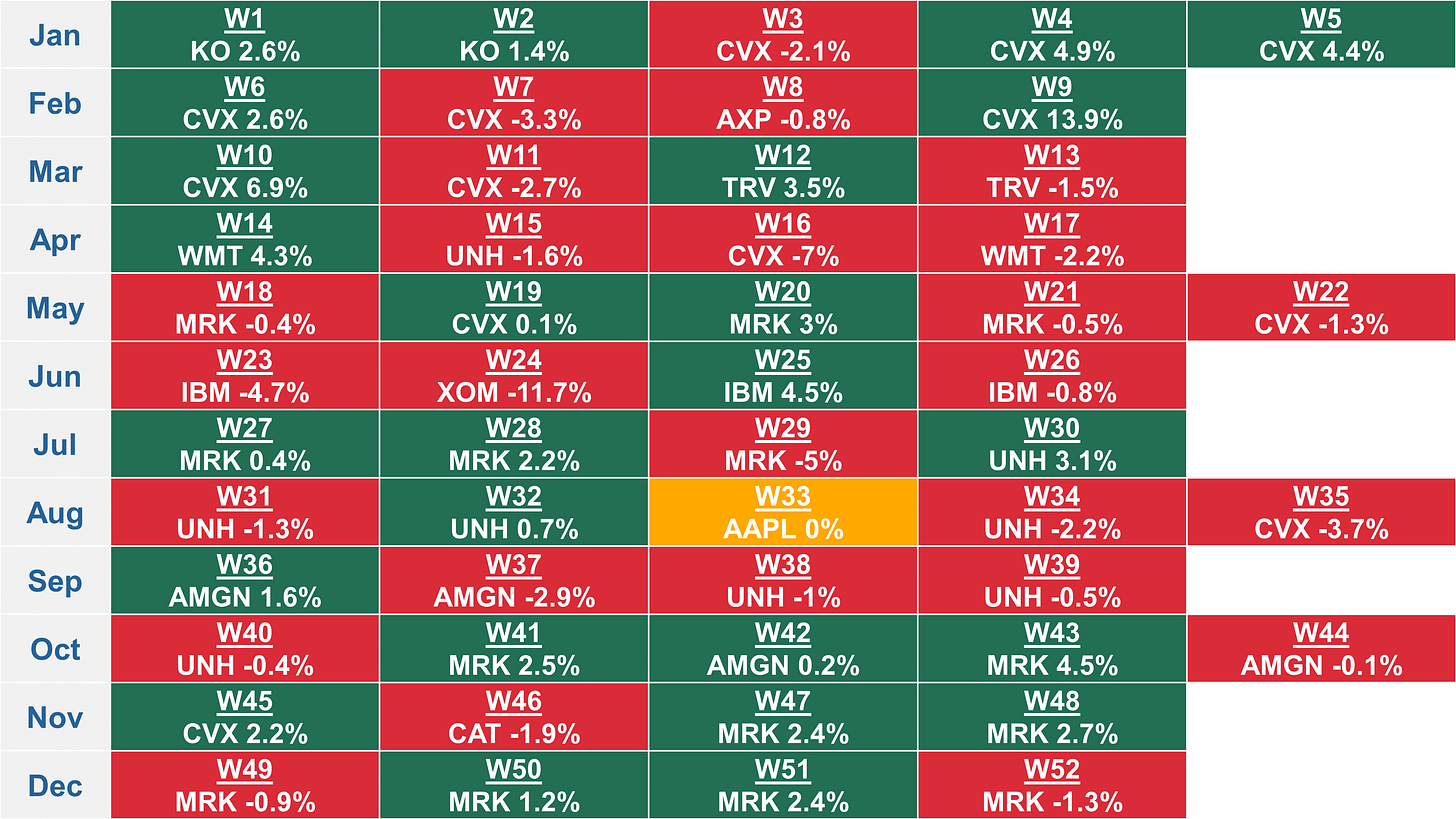

MY WEEKLY STOCK PICKS SINCE 2019

Weekly performance based on an entry at the Monday open and an exit at the Friday close, excluding transaction fees and dividends

2023: -7%

2022: +13%

2021: +44%

2020: +86%

2019: +48%

DISCLAIMER

The information provided in this newsletter is for informational purposes only and should not be taken as financial advice. Any investments or decisions made based on the information provided in this newsletter are the reader's sole responsibility. We recommend that readers conduct their own research and consult a qualified financial professional before making investment decisions. The author does not assume any responsibility for any losses or damages arising from using the information provided in this newsletter.

I'm doing well this year, up ~48% as of today so can't really complain.

I am very exposed to tech though but I feel comfortable having a high risk portfolio.