Weekly Market Recap (Aug 5-9): There and Back Again - The S&P 500 Recovers from Monday's Sell-Off. All Clear Ahead?

Everything you need to know about last week's markets performance and what to expect next.

Dear subscribers,

Welcome to My Weekly Stock, where we blend in-depth market analysis with proven momentum-based trading strategies. My mission? Help you navigate the financial markets with unbiased, data-driven insights you can act on!

Every week, I spend hours curating this market recap, producing insightful analyses with clear visuals and a structured layout so you can easily find what you need, week after week. And because it's easy to get swayed by personal bias, I like to let the data do most of the talking.

Remember to upgrade your subscription to access all my trading and investing portfolios, and see how I protect my gains in these turbulent times!

Let’s get started!

SUMMARY

Here are this week's highlights and what to look out for next:

1. The markets were mixed this week, with the S&P 500 flat, the Nasdaq down 0.2%, and the Dow Jones down 0.6%. Industrials (+1.3%) and Energy (+1.1%) were the best-performing sectors.

2. The S&P 500's long-term trend is positive, however, short-term momentum is mixed. 5,380 is the next resistance, while 5,300 is support.

3. The earnings season is well under way and 455 companies from the S&P 500 index have released their Q2 results, with 78% beating estimates. Earnings are expected to be up 12% in Q2 2024 and 11% in 2024.

4. Market sentiment is at the "Extreme Fear" level (24) as measured by CNN’s Fear & Greed indicator, while VIX is at a high value of 20.

5. Earnings reports from Walmart and Home Depot, as well as theCPI and PPI reports are scheduled for next week.

My take:

What a week that kicked off with a harsh sell-off across all risky assets, with the S&P 500 down over 4% on Monday at its lows. The VIX shot above 50, reflecting the level of fear in the markets and evoking memories of the COVID crash. However, after that, the index was in recovery mode, ultimately closing the week almost unchanged.

Volatility could remain elevated in the coming days, and 100-point intraday swings in the S&P 500 are still possible. My approach here is to zoom out and be patient. While the price action after Monday's sell-off was encouraging, we are not yet entirely out of the woods. I'd like to see more follow-through from the bulls, and that starts with moving above the 3,380-3,400 area and reclaiming the 21-day EMA. Until then, we remain at risk of making new lows.

PERFORMANCE RECAP

1. S&P 500 Sector Performance

Over the week, 5 of the 11 S&P 500 sectors have achieved gains. Industrials led the way, rising by 1.3%. By contrast, Materials was the weakest, falling by -1.6%.

Year-to-date, 10 sectors have seen positive results. Communication Services has been the most successful sector, with a 17% gain. On the other hand, Consumer Cyclical has been trailing behind.

2. S&P 500 Top & Worst Performers

In the last 5 trading days, 44% of the stocks in the S&P 500 index rose in value.

The best-performing stocks were:

Axon Enterprise Inc (AXON, 25%)

Fortinet Inc (FTNT, 23%)

Kellanova Co (K, 19%)

Meanwhile, the worst-performing stocks were:

Charles River Laboratories International Inc. (CRL, -14%)

Warner Bros. Discovery Inc (WBD, -15%)

Super Micro Computer Inc (SMCI, -19%)

In addition, 33 stocks within the S&P 500 reached a new 52-week high, while 32 set new lows. Most of the highs this week came from the Consumer Defensive sector.

MARKET TRENDS & MOMENTUM

1. S&P 500 Long-Term Trend

The long-term trend for the S&P 500 is positive. I base this evaluation on the 9 and 30-week exponential moving averages (EMAs). To determine if the trend is strongly positive, I look for the following conditions (the 1st is the most important):

9-week EMA is above the 30-week EMA: 🟢

Price is trading above the 9-week EMA: 🔴

Price is trading above the 30-week EMA: 🟢

The 9-week EMA trend line is rising: 🟡

The 30-week EMA trend line is rising: 🟢

I also use the MACD as an additional tool to detect trend changes. The MACD is below its signal line, a negative indication for the index.

2. S&P 500 Technical Analysis

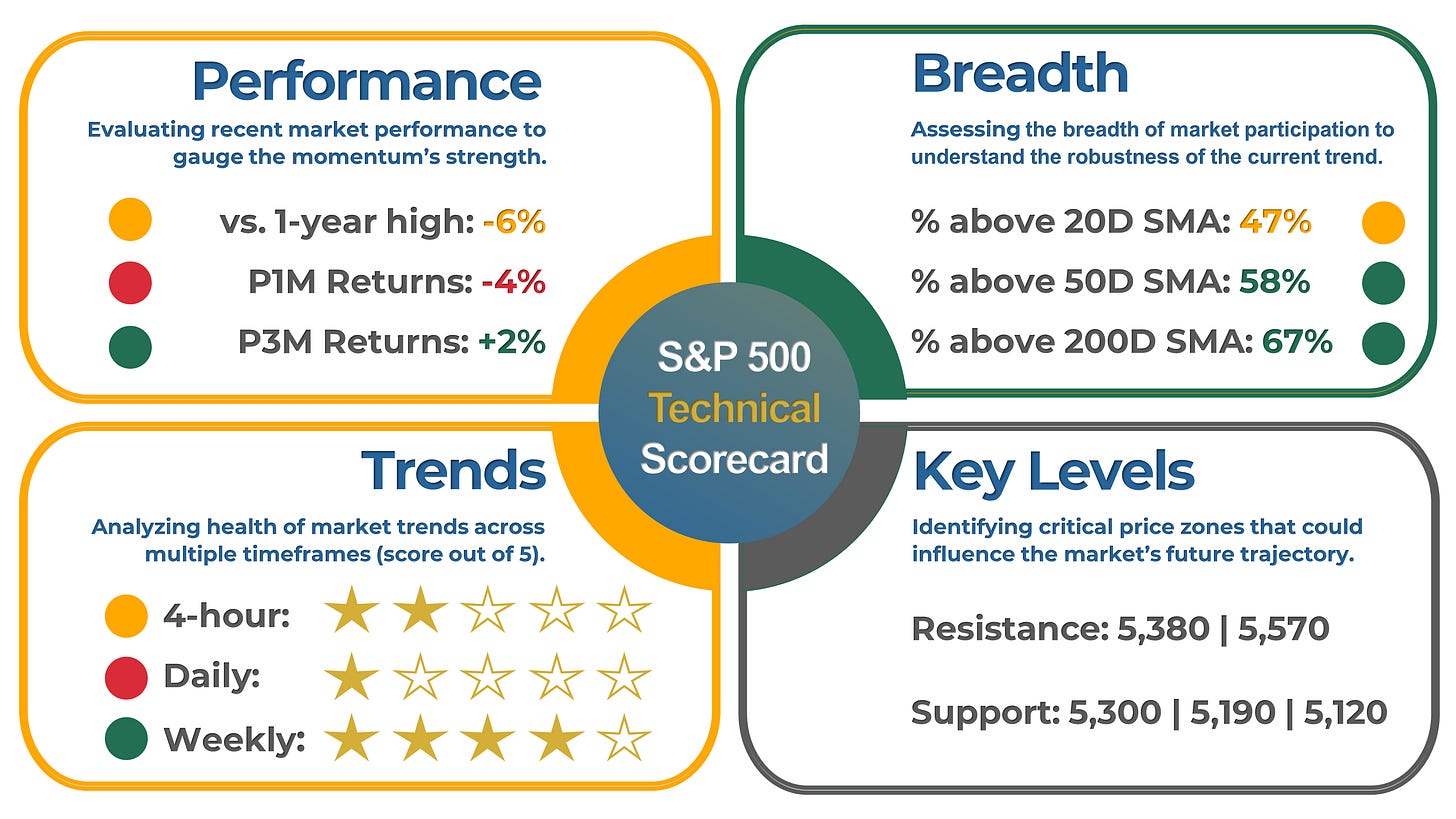

Healthy bull markets typically see the index set several new highs, broad market participation, and ascending trend lines. That's why I've created a four-part scorecard – a straightforward tool to give us a comprehensive view of these essential health indicators.

Momentum: The index is down 4% over the past month, up 2% in the last three months, and is trading 6% away from its 52-week high.

Breadth: Market participation remains healthy in the long term, as 69% of S&P 500 stocks are trading above their 200-day moving average (SMA). Meanwhile, 49% of the stocks are trading above their 20-day SMA, down by 18 points compared to the previous week. A reading above 80% or below 20% typically indicates an overextended trend.

Trends: The trend on the 1-day chart is negative, with the index trading below its 21-period exponential moving average. However, we see some encouraging signs on the 4-hour chart.

Key levels: The next resistance level is 5,380. On the other hand, the next support areas are at 5,300, followed by 5,190.

3. Momentum Analysis of the Week

This week's momentum analysis is about the Online Retail industry. Using a combination of performance metrics and technical indicators, I've developed a proprietary algorithm to rank 9 stocks from this industry. Based on this approach, I've identified MercadoLibre ($MELI) and Ebay ($EBAY) as having the best relative momentum currently.

EARNINGS RECAP

1. Q2 and Full Year 2024 Expected EPS & Revenue Growth

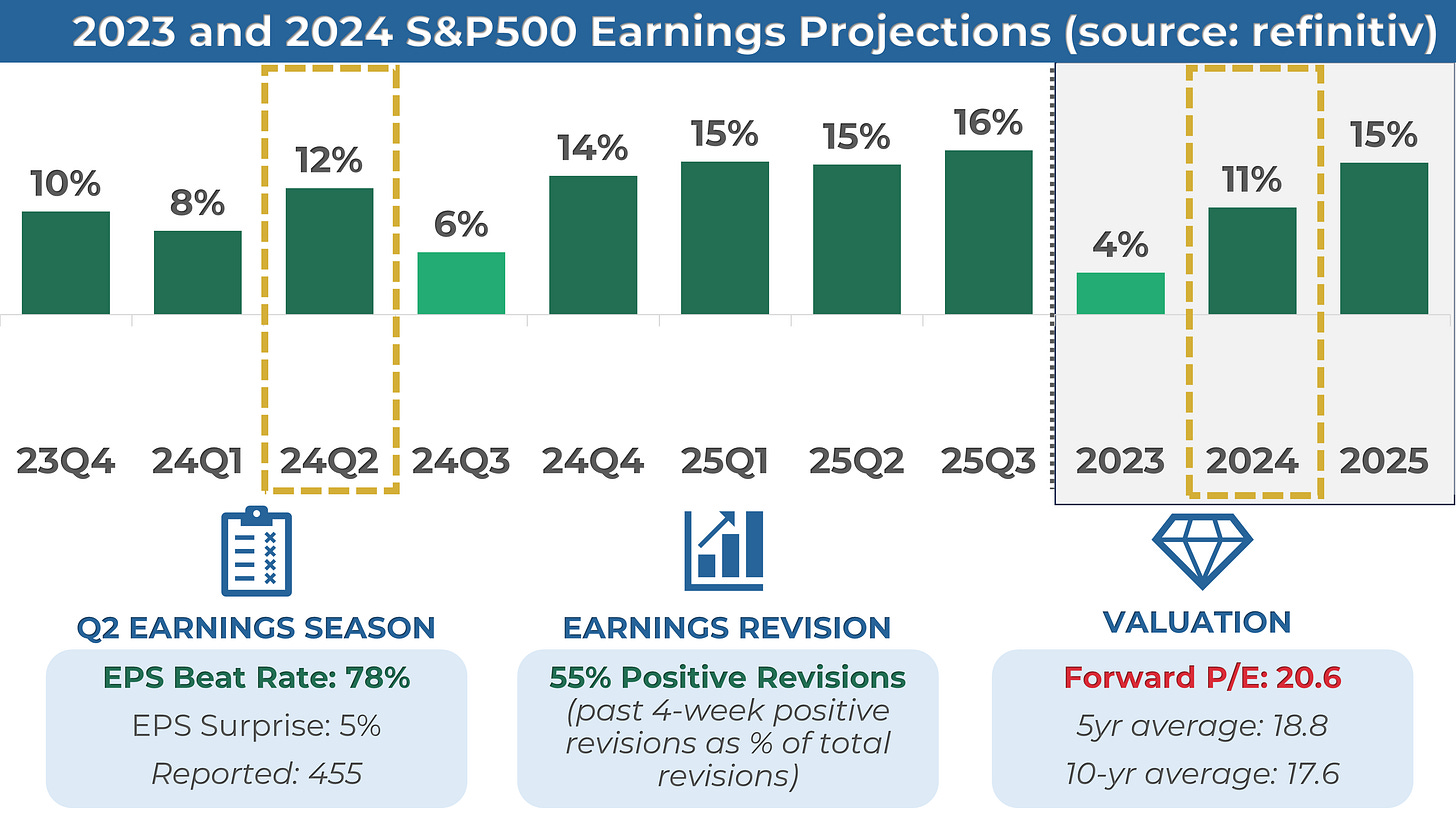

Q2 2024 earnings for the S&P 500 are expected to be up 12%. Excluding the energy sector, the figure is +13%.

Earnings are projected to grow by 11% in 2024, higher than the 9% growth seen on average over the last decade. In the past four weeks, 55% of earnings revisions made by analysts were to increase their outlook.

The forward 4-quarter P/E ratio is 20.6, higher than the average over the past five and ten years.

2. Q2 Earnings Season Summary

450 companies from the S&P 500 index have released their Q2 2024 earnings, with 78% posting higher EPS than expectations. This is slightly below the previous four-quarter average of 79% and higher than the historical average of 67%.

MARKET SENTIMENT

Measures of investor sentiment can be helpful as they provide insight into the views and opinions of professional or individual investors. However, it's important to note that these measures are not perfect predictors of market movements. They should be combined with other indicators and analysis tools for a complete market picture.

1. AAII Sentiment Survey (Individual Investors)

The American Association of Individual Investors (AAII) conducts a weekly survey among its members to gauge their expectations for the stock market over the next six months. The results are published every Wednesday.

According to the most recent AAII survey, 41% of the respondents had a bullish outlook on the stock market, decreasing by 4 points from the previous week.

2. BofA Bull & Bear Indicator (Institutional Investors)

The Bank of America Bull-Bear Indicator is a proprietary measure of investor sentiment developed by Bank of America. It is based on a survey of fund managers and institutional investors, and it tracks the percentage of respondents who are bullish, bearish, or neutral on the stock market. Results are published in the form of a score ranging from 0 (extremely bearish) to 10 (extremely bullish)

The indicator decreased from 6.6 to 6.3, a bullish sentiment reading.

3. CNN Fear & Greed Index (Technical)

The CNN Fear & Greed Index is a daily measure that analyzes seven market indicators to assess how emotions influence investors' decisions. The index is scored out of 100 and categorizes results into five stages: Extreme Fear, Fear, Neutral, Greed, and Extreme Greed.

The index closed at 24 or an “Extreme Fear” level, down from 27 last Friday.

THE WEEK AHEAD

1. Economic Calendar

A busy week of economic data is upon us, and all eyes will be on the inflation reports. The Producer Price Index (PPI) will be released on Tuesday, followed by the Consumer Price Index (CPI) on Wednesday. On Thursday, Retail Sales data for July will be published. These reports will surely have market-wide implications, especially as investors assess economic conditions and the likelihood of a rate cut from the Fed.

2. Earnings Calendar

Earnings season continues next week, and 9 companies from the S&P 500, including Walmart and Home Depot, are expected to release their quarterly results.

3. Next Week’s Earnings Watchlist

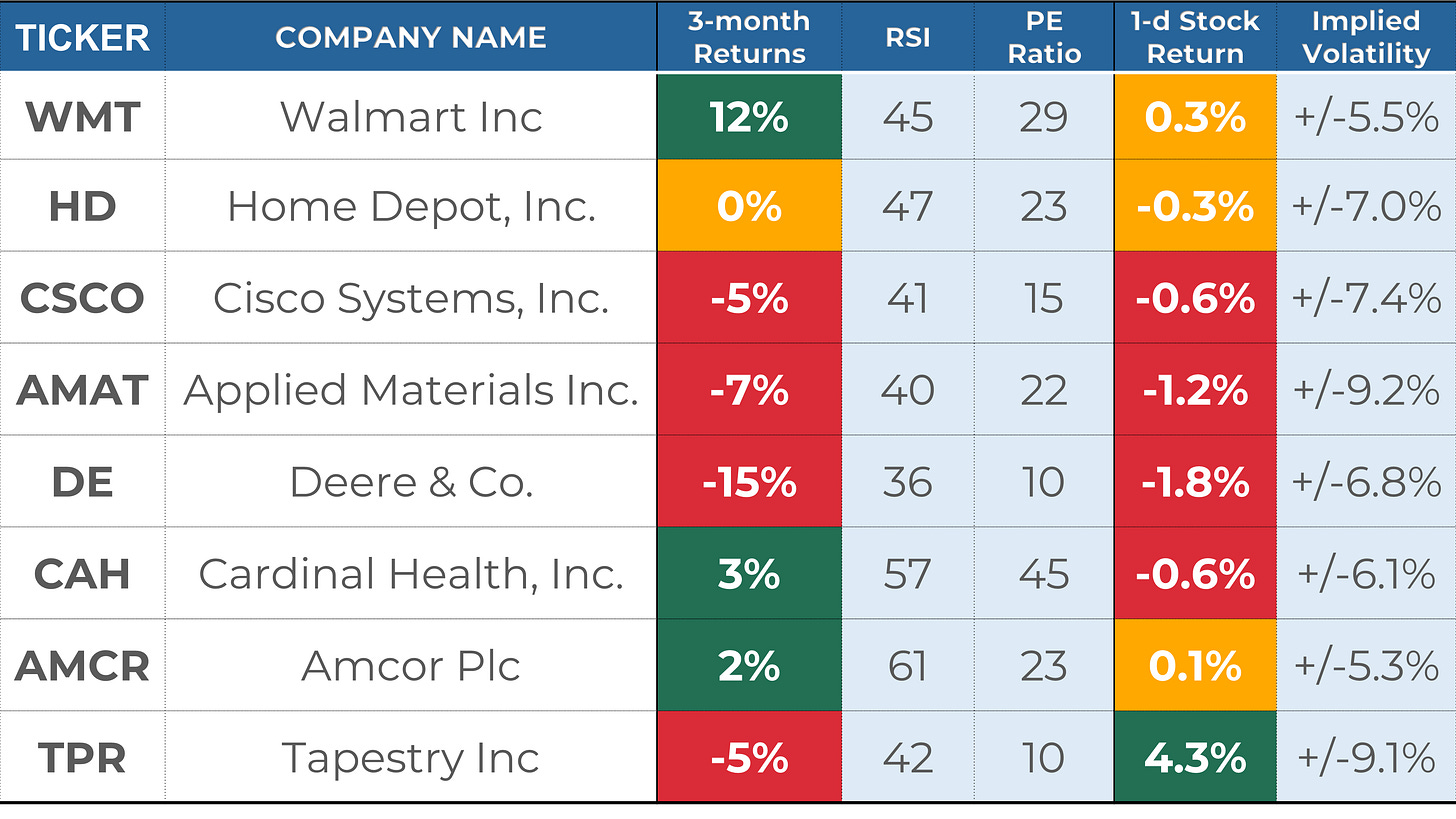

Below is my watchlist of stocks reporting week next week, along with several key indicators I like to review:

Stock Indicators:

Stock performance in the last 3 months.

RSI, where a reading of 70 indicates overbought status and a reading of 30 oversold.

PE ratio, where a reading below 25 indicates a "cheap" valuation and/or low growth expectations.

Stock Price Reactions to Earnings:

1-day Stock Return on Earnings is the stock performance on the earnings release date.

Implied volatility is the expected 1-day stock change after earnings are released, as assessed by the options markets.

Every week, I share my analysis of 1 stock reporting earnings in the coming days, focusing on implications for long-term investors. This week, I prepared an in-depth overview of Cisco ($CSCO). In this post, I break down key data points around $CSCO’s fundamentals, stock returns, analyst ratings, and past earnings performance to help you make informed investment decisions. Check out the post and learn why I gave a “PASS” rating to Cisco.

That’s a wrap for this week’s recap! I hope it helped you understand the market better.

If you enjoyed this post, you should explore the premium section: I provide my short-term trading and analysis of over 20 US large caps and share my long-term investing portfolios. Upgrade your subscription to unlock all the exclusive features and insights.

If you have any questions or feedback, please don't hesitate to email me or comment on this post. Your support helps me create high-quality content and is greatly appreciated!

Have a great week!

My Weekly Stock

DISCLAIMER

The information provided in this newsletter is for informational purposes only and should not be taken as financial advice. Any investments or decisions made based on the information provided in this newsletter are the reader's sole responsibility. We recommend that readers conduct their own research and consult a qualified financial professional before making investment decisions. The author does not assume any responsibility for any losses or damages arising from using the information provided in this newsletter.

Immaculate article, job well done!

Great write up per usual. Nice to see the same number of stocks making new highs as are making new lows. That is exactly what a pullback in a bull market looks like, and not what a bear market looks like. Thanks for sharing!