Weekly Market Recap (Jan. 16 - 20)

Everything you need to know about last week's markets performance and what to expect next

Dear subscribers,

Welcome to our weekly market recap!

Navigating the markets can be overwhelming, but I'm here to provide you with the latest updates and actionable insights to help you succeed. Whether you're an experienced investor or just starting out, my recap has something for everyone.

I hope you enjoy this week's edition and find it helpful. If you like what you see, please share it with your network on social media and, if you haven't already, subscribe to our email updates.

Thank you for joining us, and let's get started!

SUMMARY

Here are this week's highlights and what to look out for next:

1. The markets were negative, with the S&P 500 down 0.7%, the Dow Jones 2.7%, while the Nasdaq was up 0.7%. Communication Services (+1.4%) and Technology (+0.7%) were the best-performing sectors.

2. Growing recession fears weighed on the markets this week, as the 1.1% drop in retail sales in December provided further indications that the economy may be slowing.

3. The long-term trend is mixed for the S&P 500 based on the weekly chart. We need to break out from the downtrend channel that started in January 2022 before turning more bullish.

4. The earnings season is now well underway, and 55 companies from the S&P 500 index have released their Q4 results, with 64% beating estimates. Earnings are expected to fall 3% in Q4 2022 and rise 4% in 2023.

5. Earnings reports from Tesla, Microsoft and Chevron are scheduled for next week, along with the release of the Q4 GDP data.

My take:

Last week, I stated that the stock market index was facing a major test as it sat right at its downtrend channel. However, this week's attempt to break out failed, similar to previous attempts in 2022. My perspective remains the same: I want to see a successful and sustainable breakout before becoming more optimistic about the market outlook. Until a resistance (or support) level is broken, I view the current market movements as mostly noise.

PERFORMANCE RECAP

1. SP500 Sector Performance

Over the week, 3 of the 11 S&P 500 sectors had achieved gains. Communication Services led the way, rising by 1.4%. By contrast, Industrials was the weakest, falling by 3.4%.

Year-to-date, 8 sectors have seen positive results. Communication Services has been the most successful sector, with an 11% gain. On the other hand, the Consumer Defensive sectors have been trailing behind.

2. S&P 500 Weekly Heat Map

Over the last five trading days, only 35% of the stocks in the S&P 500 index have risen in value.

The best-performing stocks were:

SVB Financial Group (SIVB, 15%)

ResMed Inc. (RMD, 10%)

Match Group, Inc. (MTCH, 9%)

Meanwhile, the worst-performing stocks were:

Lumen Technologies, Inc. (LUMN, -14%)

Emerson Electric Co. (EMR, -11%)

The Allstate Corporation (ALL, -8%)

In addition, 4 stocks within the S&P 500 reached a new 52-week low, while 23 set new highs.

MARKET TRENDS & MOMENTUM

1. S&P 500 Long-Term Trend

The long-term trend for the S&P500 is mixed, according to my analysis. I base this evaluation on the weekly chart's 9 and 30 exponential moving averages (EMAs). To determine if the trend is strongly positive, I look for three conditions:

Price is trading above the EMA9 and EMA30: 🟡

EMA9 is above the EMA30: 🔴

Both moving averages are rising: 🟡

I also use MACD as an additional tool to detect trend changes. The MACD is currently higher than its signal line, a positive indication for the index.

2. Short-term outlook and key levels

The S&P 500 failed to break out from the downtrend channel that started in January 2022. We've seen many failed attempts, notably in March, August, and December, so it is fair to expect this time won’t be any easier. The outlook would become much more bullish if we achieved a successful breakout.

Regarding specific levels to watch, 4,080 (the December high) is a significant resistance. On the other hand, 3,720-60 is a key support range.

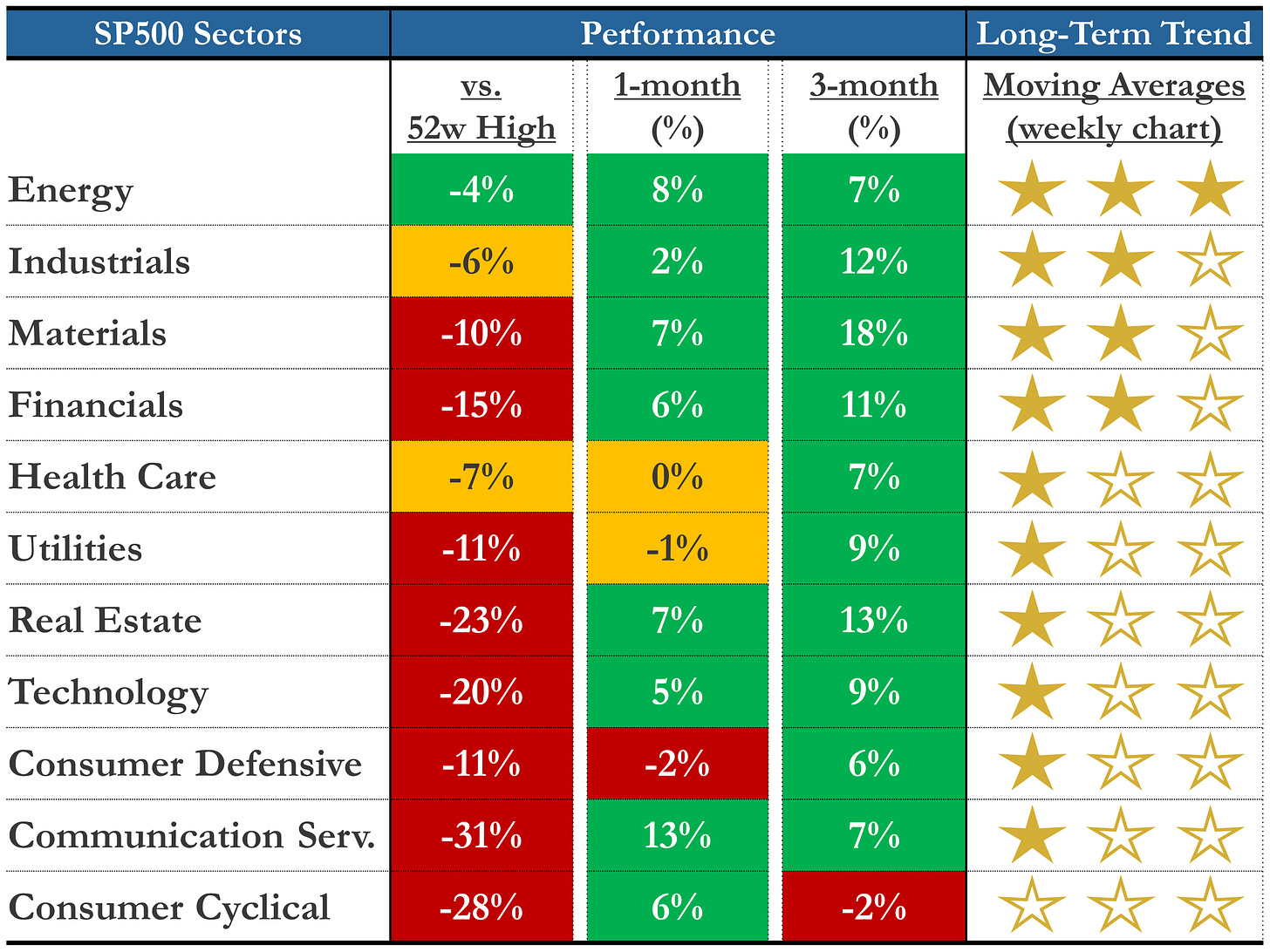

3. S&P 500 Sectors Momentum

My stock-picking strategy is centered around momentum analysis. I employ various performance metrics and technical indicators, which are then processed by my proprietary algorithm. I use this model here to rank the different S&P 500 sectors and identify those likely to outperform.

This week is Energy and Industrials turn to shine, and I encourage fellow momentum traders to investigate these sectors and the best-performing stocks within them.

EARNINGS RECAP

1. Earnings Season Summary

55 companies from the S&P 500 have released their Q4 2022 earnings, with 64% posting higher EPS than expectations. However, this is lower than the previous four-quarter average of 76%.

2. Expected EPS & Revenue Growth

Analysts predict that earnings for the S&P 500 will decline by 3% in Q4 2022. Excluding the energy sector, the figure falls to -7%.

The earnings growth rate for 2023 is projected at 4%, lower than the 9% average seen over the last decade. Earnings are expected to increase year-over-year in 7 of the 11 sectors, with the Consumer Cyclical and Financials sectors leading the way. On the other hand, the Energy and Materials sectors are projected to see a decrease.

MARKET SENTIMENT

Measures of investor sentiment can be helpful as they provide insight into the views and opinions of professional or individual investors. However, it's important to note that these measures are not perfect predictors of market movements. They should be combined with other indicators and analysis tools to get a complete market picture.

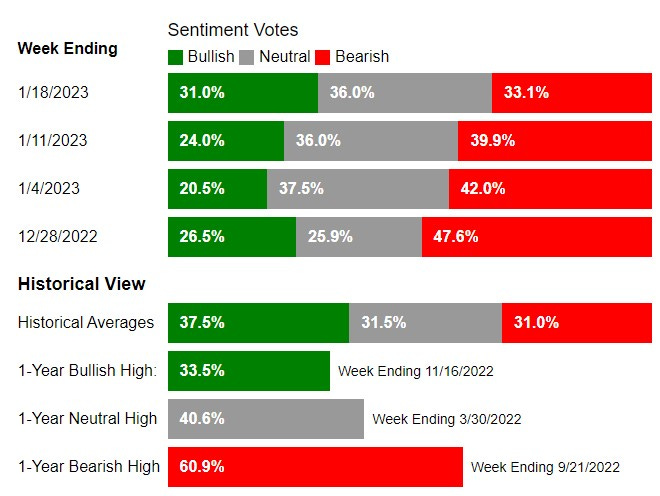

1. Individual Investors (AAII)

The American Association of Individual Investors (AAII) conducts a weekly survey among its members to gauge their expectations for the stock market over the next six months. The results of the survey are published every Wednesday.

According to the most recent AAII survey, 33% of the respondents had a bearish outlook on the stock market, a 7-point decrease from the previous week. The overall market sentiment is now back to historical levels.

2. Institutional Investors (BofA Bull & Bear Indicator)

The Bank of America Bull-Bear Indicator is a proprietary measure of investor sentiment developed by Bank of America. It is based on a survey of fund managers and institutional investors, and it tracks the percentage of respondents who are bullish, bearish, or neutral on the stock market. Results are published in the form of a score ranging from 0 (extremely bearish) to 10 (extremely bullish)

The indicator rose from 3.0 to 3.5 and, while improving, still indicates a primarily bearish sentiment among professional investors.

THE WEEK AHEAD

1. Economic Calendar

Next week, the spotlight will be on the economy, with the Q4 GDP data due on Thursday. We will also get another inflation update with the PCE Price Index, the Fed's favorite measure of inflation.

2. Earnings Calendar

88 companies from the S&P 500, including Tesla, Microsoft, and Chevron, are set to report their quarterly earnings next week.

3. Next Week’s Earnings Watchlist

Thank you for reading my weekly market recap! I hope you found it helpful in understanding the stock markets better. If you did, please share this post with your friends and followers.

If you have any questions or feedback, please don't hesitate to reach out by email or in the comment section. Your support helps me to continue creating high-quality content and is greatly appreciated!

Have a great week!

My Weekly Stock

DISCLAIMER

The information provided in this newsletter is for informational purposes only and should not be taken as financial advice. Any investments or decisions made based on the information provided in this newsletter are the reader's sole responsibility. We recommend that readers conduct their own research and consult a qualified financial professional before making investment decisions. The author does not assume any responsibility for any losses or damages arising from using the information provided in this newsletter.