Weekly Market Recap (Jun 23-27): New Highs, Same Lesson: Trust the Trend, Not the Noise

Everything you need to know about last week's markets performance and what to expect next.

Dear readers,

Welcome back to My Weekly Stock, where in-depth market analysis meets proven momentum-based trading strategies. My mission? To help you win in the markets with unbiased, data-driven insights you can act on.

Friday means it's time to review the week in the markets. Each week, I dedicate hours to curating this market recap, preparing insightful analysis with clear visuals and a structured layout—making it easy for you to find exactly what you need, week after week. And because it's easy to get swayed by personal bias, I like to let the data do most of the talking.

If you want the full experience, consider upgrading your subscription. Paid members get access to all my portfolios, in-depth analysis, and a clear momentum-based framework you can follow and learn from.

Start today. Your first month is completely FREE. If you’re ready to give it a try—or just want to support my work—this is your chance!

Let's dive in!

SUMMARY

Here are this week's highlights and what to look out for next:

1. The markets were positive this week, with the S&P 500 up 3.4%, the Nasdaq 4.3%, and the Dow Jones 3.8%. Communication Serv. (+4.7%) and Technology (+4.2%) were the best-performing sectors.

2. The S&P 500's long-term trend is positive, and the short-term momentum is also positive. 6,200 is the next resistance, while 6,080 is support.

3. The Q1 earnings season is almost over and 498 companies from the S&P 500 index have released their quarterly results, with 76% beating estimates. Earnings are expected to be up 14% in Q1 and 9% in 2025.

4. Market sentiment is at the "Greed" level (65/100) as measured by CNN’s Fear & Greed indicator, while VIX is at a medium value of 16.

5. Earnings report from Constellation Brands and the Non-Farm Payroll report are scheduled for next week.

My take:

This week highlighted the risks of relying on mainstream media for market direction. Despite expectations of a market downturn following the US strike on Iran, the market remained resilient, and the S&P 500 ended the week up 3%, closing at a new record high.

In recent months, the markets have shown an impressive recovery, with a V-shaped recovery since hitting a low early April. The key question now is whether this marks the start of a new upward trend or a double top. I will continue to monitor market momentum to guide my bias, especially as this week served as a clear reminder to trade the trend, not the headlines.

PERFORMANCE RECAP

1. S&P 500 Sector Performance

This week, 8 out of the 11 S&P 500 sectors posted gains. Communication Serv. led the market with a 4.7% increase, while Energy was the laggard, dropping 4.1%.

Year-to-date, 8 sectors have achieved positive performance. Industrials is the top-performing sector with a 11.4 % gain, while Health Care lags behind, with a 2.7 % loss.

2. S&P 500 Top & Worst Performers

Over the last five trading days, 76% of the stocks in the S&P 500 index rose in value.

Top Performers:

$NKE (Nike, Inc): 20.5%

$ANET (Arista Networks Inc): 15.2%

$CCL (Carnival Corp): 14.7%

$ALB (Albemarle Corp): 14.6%

$COIN (Coinbase Global Inc): 14.6%

Worst Performers:

$OXY (Occidental Petroleum Corp): -6.6%

$APA (APA Corporation): -7.1%

$HAL (Halliburton Co): -7.7%

$CF (CF Industries Holdings Inc): -9.3%

$EQIX (Equinix Inc): -11.1%

In addition, 34 stocks within the S&P 500 reached a new 52-week high, while 12 stocks set new lows. The majority of this week’s highs came from the Technology sector.

Notable Highs:

$MSFT (Microsoft Corporation)

$NVDA (NVIDIA Corp)

$AVGO (Broadcom Inc)

$JPM (JPMorgan Chase & Co)

$ORCL (Oracle Corp)

Notable Lows:

$ACN (Accenture plc)

$PEP (PepsiCo Inc)

$CPRT (Copart, Inc)

$LULU (Lululemon Athletica inc)

$STZ (Constellation Brands Inc)

MARKET MOMENTUM

1. Momentum Review

To evaluate the market's current health, I examine 4 key elements: performance, breadth, trends, and key levels. Healthy bull markets typically feature indices setting new highs, broad market participation, and ascending trend lines.

Performance (POSITIVE 🟢): evaluating recent market performance to gauge the momentum’s strength. Ideally i want to see returns accelerating short-term and index trading less than 5% from its 1-year high

1-month performance: +4.6% 🟢

3-month performance: +8.4% 🟢

vs. 1-year high: 0%🟢

Breadth (MIXED 🟡): assessing market participation to understand the health of the trend. Extreme levels (above 80% or below 20%) may indicate overextended trends.

% of stocks above 200-day moving average: 51% (up from 45% last week) 🟡

% of stocks above 20-day moving average: 66% (up from 46% last week) 🟢

Trends: analyzing trend strength across multiple timeframes using exponential moving averages, scored on a scale of 1 to 5. A score of 3 or above suggests solid trends and supports holding a position.

Weekly chart: STRONG ⭐️⭐️⭐️⭐️ (stable vs last week)

Daily chart: STRONG ⭐️⭐️⭐️⭐️ (improving vs last week)

4-hour chart: STRONG ⭐️⭐️⭐️⭐️ (improving vs last week)

Key levels: identifying critical price zones to confirm the current trend or signal a potential reversal.

Support:

5,850 (-5.2%)

5,920 (-4.1%)

6,080 (-1.5%)

Resistance:

6,200 (+0.4%)

6,250 (+1.2%)

6,400 (+3.7%)

2. Post of the Week

This week's momentum analysis is about the Mega Caps. Using a combination of performance metrics and technical indicators, I've developed a proprietary algorithm to rank 10 mega-cap stocks. Based on this approach, I've identified Microsoft (MSFT) and Nvidia (NVDA) as having the best relative momentum currently.

EARNINGS & ECONOMIC REPORTS RECAP

1. Earnings Outlook

Q1 Earnings: S&P 500 earnings are expected to grow by 14%, rising to 16% when excluding the energy sector.

2025 Full-Year Outlook: Earnings are expected to increase by 9%, in line with the 10-year average growth of 9%.

Analyst Revisions: Over the past month, 55% of all earnings revisions by analysts have been upward adjustments to their outlook.

Valuation: The forward 4-quarter P/E ratio stands at 22.8, above the 5-year and 10-year historical averages.

2. Earnings Season Recap

Out of 498 S&P 500 companies that have reported first-quarter earnings, 76% exceeded EPS expectations. It is in line with the four-quarter average of 77% and above the historical average of 67%.

Below are some notable companies that reported earnings last week. I’ve highlighted their EPS and revenue performance vs estimate, as well as their stock return this week.

One highlight of the week was Nike ($NKE), which soared 15% on Friday after beating Revenue and EPS estimates.

3. Economic Reports

It was an important week filled with critical economic updates, including GDP revisions and the Fed's preferred inflation gauge. Markets also closely monitored two days of testimony from Fed Chair Powell, looking for further clues on the central bank's policy path.

Key reports included:

GDP (Thu): The final Q1 estimate showed the economy contracted -0.5% QoQ, a deeper decline than the previous -0.2%, and a sharp reversal from 2.4% growth in Q4.

Core PCE Price Index (Fri): The Fed's preferred inflation gauge continued to trend higher. YoY inflation rose to 2.7%, up from 2.6% in April, while MoM prices increased 0.2%, slightly above the previous 0.1%.

MARKET SENTIMENT

Measures of investor sentiment can be helpful as they provide insight into the views and opinions of professional or individual investors. While not definitive predictors of market direction, these measures can serve as a valuable complement to other indicators and analysis tools, helping to paint a more comprehensive picture of the market's current state.

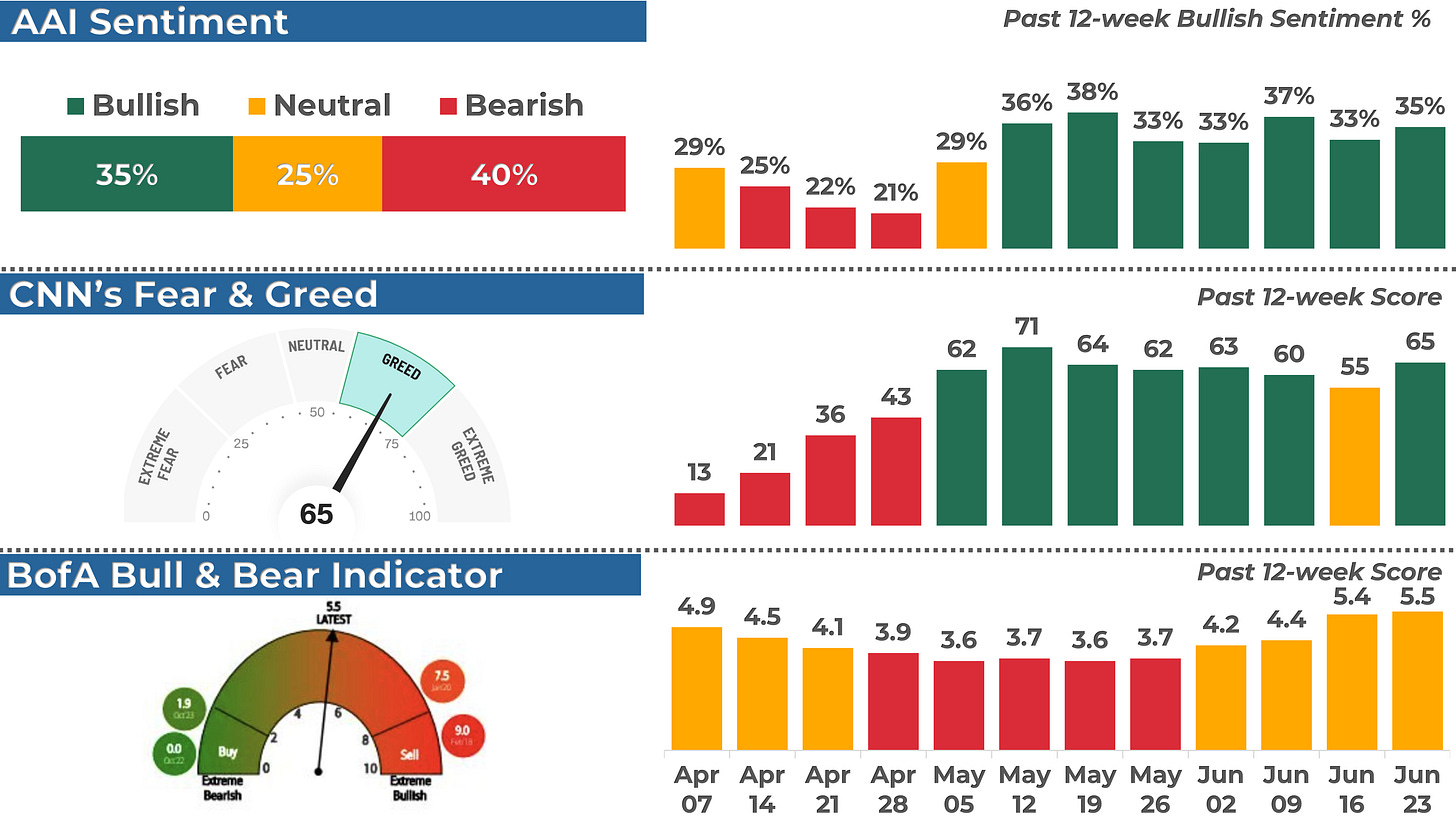

1. AAII Sentiment Survey (Individual Investors)

The American Association of Individual Investors (AAII) conducts a weekly survey to gauge members' expectations for the stock market over the next six months. Results are published every Wednesday.

In the latest survey, 35% of respondents had a bullish outlook, up from 33% the previous week.

2. BofA Bull & Bear Indicator (Institutional Investors)

The Bank of America Bull-Bear Indicator measures investor sentiment based on fund managers' and institutional investors' views. Scores range from 0 (extremely bearish) to 10 (extremely bullish).

The most recent reading was 5.5, a neutral sentiment reading.

3. CNN Fear & Greed Index (Technical)

This daily measure analyzes seven indicators to assess how emotions drive market decisions. Scores range from Extreme Fear to Extreme Greed.

The index closed at 65 (Greed), up from 55 last Friday.

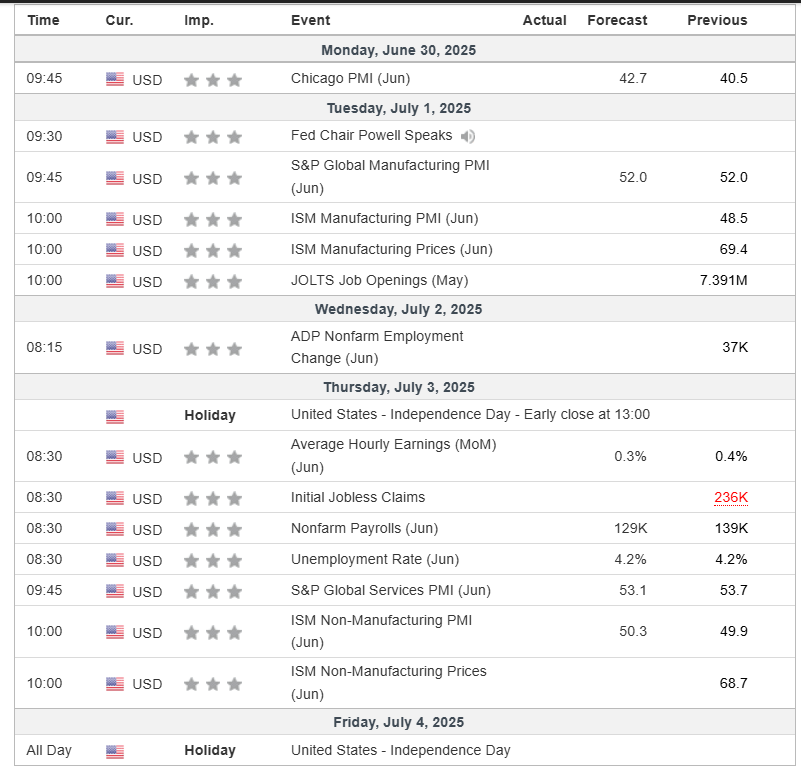

THE WEEK AHEAD

1. Economic Calendar

Next week will be a short trading week in the U.S. due to the Independence Day holiday. Markets will close early on Thursday and remain fully closed on Friday. Despite the lighter schedule, the week will still feature the June jobs report.

Key reports to watch:

Nonfarm Payrolls (Thu): The U.S. economy is expected to add 129K jobs in June, down from 139K in May.

Unemployment Rate (Thu): Forecast to hold steady at 4.2%, the same as last month.

Average Hourly Earnings (Thu): Wage growth is expected at +0.3% MoM, a slight slowdown from 0.4% the previous month.

2. Earnings Calendar

The earnings season is almost over and 1 company from the S&P 500, Constellation Brands, is expected to release their quarterly results.

3. Stock Analysis of the Week

Every week, I share my analysis of 1 stock that has reported earnings in recent weeks, focusing on implications for long-term investors. This week, I prepared an analysis of Kroger ($KR).

👨💻 My View: HOLD

After nearly two years trapped in a tight range, Kroger finally broke out in early 2024, and it hasn't looked back since.

The stock has followed a steady uptrend, with the May pullback finding support right at the 30-week EMA. That's exactly what bulls want to see in a healthy trend.

Following a strong earnings report, $KR jumped 10% last week and just hit a new all-time high. Momentum looks intact and fresh highs may still be ahead.

Check out the post for more details about $KR performance, trend and key levels.

Community Spotlight

This week, I'm glad to feature

who runs , a must read for anyone serious about personal finance. Want to save money on taxes, build long term wealth, and understand advanced strategies like 72(t), Backdoor Roth IRAs, private foundations, and tax-efficient trusts? Then subscribe now. It’s free to read and packed with expert insights!CONCLUSION

Thank you for reading my Weekly Market Recap, which, I hope, got you ready for the week ahead.

If you want to take your investing journey to the next level, consider upgrading to a paid subscription. Subscribe now and learn more about my holistic, end-to-end momentum approach to investing.

Your first month is free, so this is the perfect opportunity to explore the full value of My Weekly Stock with no commitment!

Thanks again, and I look forward to sharing my market recap with you next week.

Happy investing!

My Weekly Stock

DISCLAIMER

The information provided in this newsletter is for informational purposes only and should not be taken as financial advice. Any investments or decisions made based on the information provided in this newsletter are the reader's sole responsibility. We recommend that readers conduct their own research and consult a qualified financial professional before making investment decisions. The author does not assume any responsibility for any losses or damages arising from using the information provided in this newsletter.

Thank you for the feature!

Solid recap—appreciate the clarity across sectors. Curious how you’re viewing this week’s action: do you see it as early positioning for Q3 themes, or more of a digestion phase after recent strength? Always tricky reading summer flows—interested in how you’re framing near-term risk vs opportunity.