Weekly Portfolio Update #79 (Jul 7, 2025)

Momentum-driven stock picks, swing trades and long-term portfolio updates, powered by my proprietary momentum research.

Dear readers,

Welcome back to My Weekly Stock, where in-depth market analysis meets proven momentum-based trading strategies. My mission? To help you win in the markets with unbiased, data-driven insights you can act on.

As we head into a new week, it means it's time for my Weekly Portfolio Update! In this post, I'll cover my short, mid and long-term trading strategies. Stay tuned to learn about my approach, recent moves (or planned ones), and how my strategies have performed.

Before we dive into this week’s analysis, I’m excited to share a special Independence Day offer! 🎉Until Monday at midnight, you can get 33% off a full year of My Weekly Stock. As a paid subscriber, you’ll gain exclusive access to my 3 winning portfolios—and so much more: A Clear Investing Framework, Momentum-Based Analysis and Live Portfolio Updates

If you’re ready to give it a try—or just want to support my work—this is your chance!

Let's dive in!

SUMMARY

1. Weekly Momentum Pick (my short-term tactical play):

My stock pick for this week, a leading company within the Financial sector, trading 0% from its 1-year high

Last week’s pick gained 1.2%, bringing my 2025 performance to 7%.

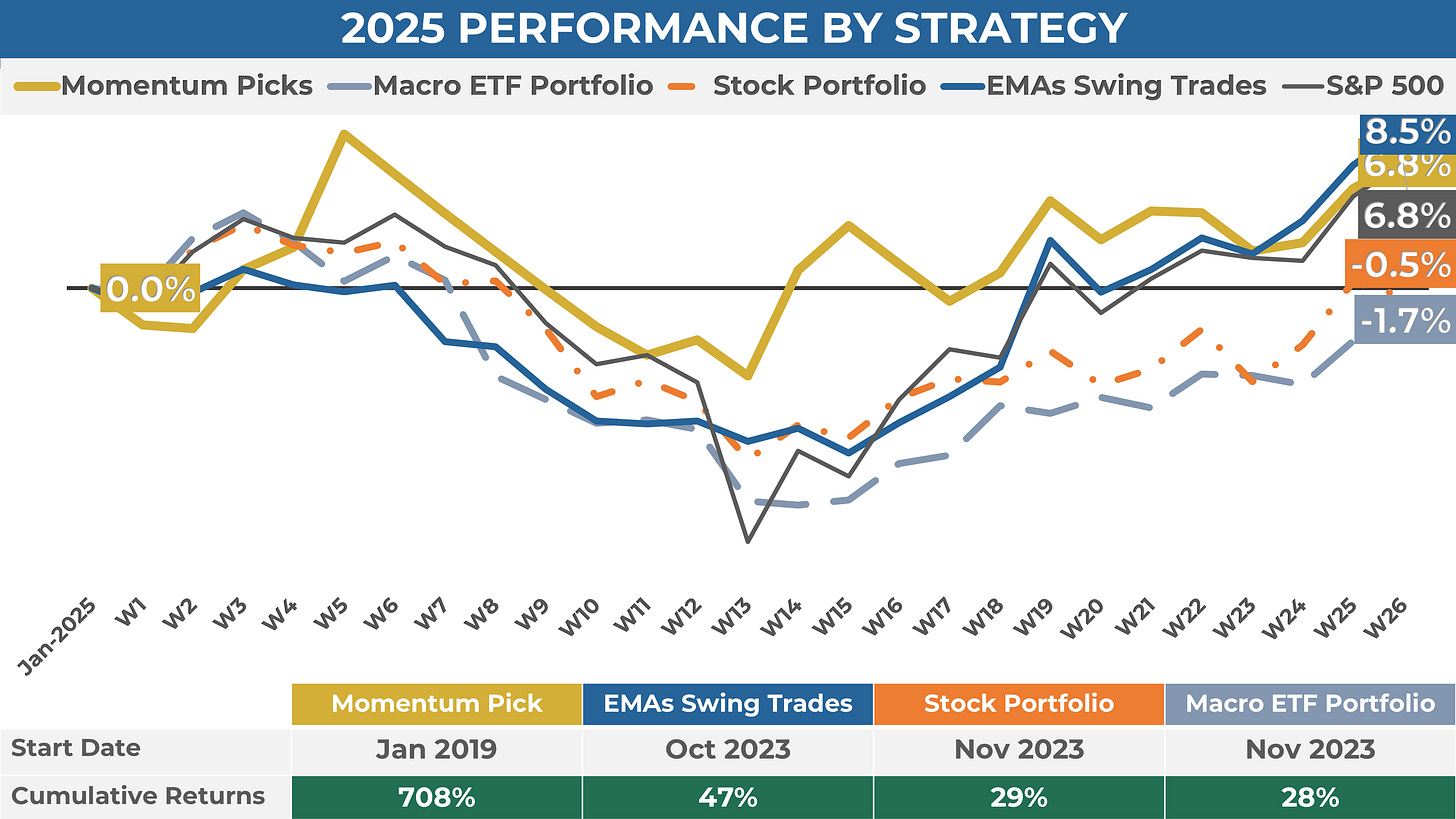

Since 2019, my momentum picks have achieved a 61% hit rate and returned 708%—outperforming the S&P 500 by 5x.

2. Swing Trade Portfolio (my comprehensive mid-term strategy):

Last week, I initiated 3 new positions. For the week ahead, I’m planning to trim 3 positions.

I own 29 positions, with 25 currently in profit. The top performers are Coinbase ($COIN, +80%) and Reddit ($RDDT, +34%).

Since its inception in October 2023, my Swing Trade Portfolio has returned 47%.

3. Macro ETF portfolio (my long-term, macro-driven allocation across equities, bonds, commodities, and crypto):

The portfolio is 91% allocated across 15 positions, and the best-performing ETFs are Bitcoin, up 289%, and $GLD (Gold), up 66%.

The cumulative return is 28% since the portfolio inception in October 2023.

4. Stock Investing Portfolio (my momentum-backed selection of fundamentally strong stocks for long-term growth):

The portfolio is 94% allocated across 19 positions, and the best-performing stocks are Netflix ($NFLX), up 213%, and $BKNG (Booking Holdings), up 104%.

The cumulative return is 29% since the portfolio inception in November 2023.

Trading Week Reflection:

It was a quieter week for me as I didn't want to force trades in the holiday-shortened schedule. With markets at all-time highs, it's becoming increasingly challenging to find high-quality setups. For now, I'm mostly riding the trend in my trading account.

We saw some rotation out of tech as the new quarter began, and a few of my positions came under pressure. However, I've been diligent about locking in profits on the way up and maintaining good exposure to cyclical stocks. That helped me navigate the week without too much damage.

Looking ahead, a market cooldown wouldn't be surprising, and it would give moving averages a chance to catch up. I'll continue trimming positions that hit my profit targets and gradually raise cash to stay ready for the next wave of opportunities.

STRATEGY & PORTFOLIO OVERVIEW

If you’re new here or want a deeper dive into my strategies, check out my detailed post below:

PERFORMANCE UPDATE

1) Momentum Pick

Since 2019, my stock picks have delivered consistently strong returns, significantly outperforming the S&P 500. The cumulative return on my weekly momentum picks stands at +708% (when traded with a stop-loss), surpassing the S&P 500 by 5x.

Last week, my stock pick gained 1.3%, bringing my 2025 performance to +7%.

2) SWING TRADE PORTFOLIO

My research and extensive back-testing have shown that this swing trade strategy can deliver substantial gains over time, both in absolute terms and relative to the benchmark index.

Since I began the tracking in October 2023, my Swing Trade portfolio has achieved a cumulative return of +47%. Last week, the portfolio gained 1.7%.

The top current performers include Coinbase ($COIN, +80%) and Reddit ($RDDT, +34%).

3) MACRO ETF PORTFOLIO

Since its inception in October 2023, the Macro ETF Portfolio has achieved a cumulative return of +28%, with the top performers being Bitcoin, up 289% and $GLD (Gold), up 66%. Over the past week, the portfolio gained 1.2%.

STOCK INVESTING PORTFOLIO

Since its inception in November 2023, the Stock Investing Portfolio has achieved a cumulative return of +29%. Top performers are $NFLX (+213%) and $BKNG (+104%). Over the past week, the portfolio lost 0.8%.

WEEKLY PICKS & PORTFOLIO UPDATES

1) Momentum Pick of the Week

Keep reading with a 7-day free trial

Subscribe to My Weekly Stock to keep reading this post and get 7 days of free access to the full post archives.