Weekly Trading Update #52 (Dec 23)

The only stocks you need to watch this week, hand-picked by my proprietary algorithm

Dear subscribers,

Welcome back to My Weekly Stock, where we blend in-depth market analysis with proven momentum-based trading strategies. My mission? Help you navigate the markets with unbiased, data-driven insights that you can act on.

As we head into a new week, it's time for my Weekly Trading Update! Stay tuned to learn more about how my trading strategies work and my performance.

Remember to upgrade your subscription if you want access to my 3 winning portfolios—and so much more: a clear investing framework, momentum-based analysis and live portfolio updates

If you’re ready to give it a try—or just want to support my work—this is your chance!

It is the final Trading Update of the year, and I’d like to take this opportunity to wish you all a joyful and relaxing holiday season. The next update will be released on Jan 6th, with some exciting improvements. And I will share via the Chat room any update on the portfolios. Until then, take care, enjoy the holidays, and I’ll see you in the new year!

THIS WEEK’S SNAPSHOT

Momentum Conditions: Markets faced a sharp sell-off midweek following the Fed's hawkish outlook, but Friday's bounce off key support keeps the Santa rally hopes alive.

Weekly Momentum Pick: $AAPL (Apple Inc) is my stock pick for this week, a leading company within the Technology sector, trading 0% from its 1-year high. Since 2019, my momentum picks have returned 654%, cumulatively.

Swing Trade Portfolio: 49% of my portfolio is invested across 14 positions. Tesla ($TSLA, +56%) and Bitcoin (BTCUSD, +62%) are the best 2 performers. Since its inception in October 2023, my Swing Trade Portfolio has returned 36%.

Trading Week Reflection

Last week was challenging to navigate, marked by steep market swings. On Thursday, I exited 8 positions, bringing my portfolio to less than 50% invested. While I missed some of Friday's recovery bounce, I have no regrets—I had to remain disciplined and protect against further downside.

Based on the daily charts of the exited positions, it's still too early to determine if the recent weakness is truly over. As always, I'll let the price action guide my next moves and be ready to jump back in if the setups justify it. Until then, wishing you all a happy holiday season!

WEEKLY MOMENTUM PICK

My Approach

I use a proprietary algorithm to collect momentum indicators for each company on my watchlist, such as performance over the last one and three months and the current price vs. their respective 52-week high and low. I then rank the stocks based on each indicator, assigning a score from highest to lowest, and the stock with the highest average score becomes my pick for the week.

From there, I developed a simple trading principle: I buy one stock on Monday at the market open and sell it by Friday's close. I focus on the 30 stocks from the Dow Jones (+ Alphabet). Because the strategy rewards winners, the algorithm usually selects the same stock for multiple weeks in a row.

My Performance

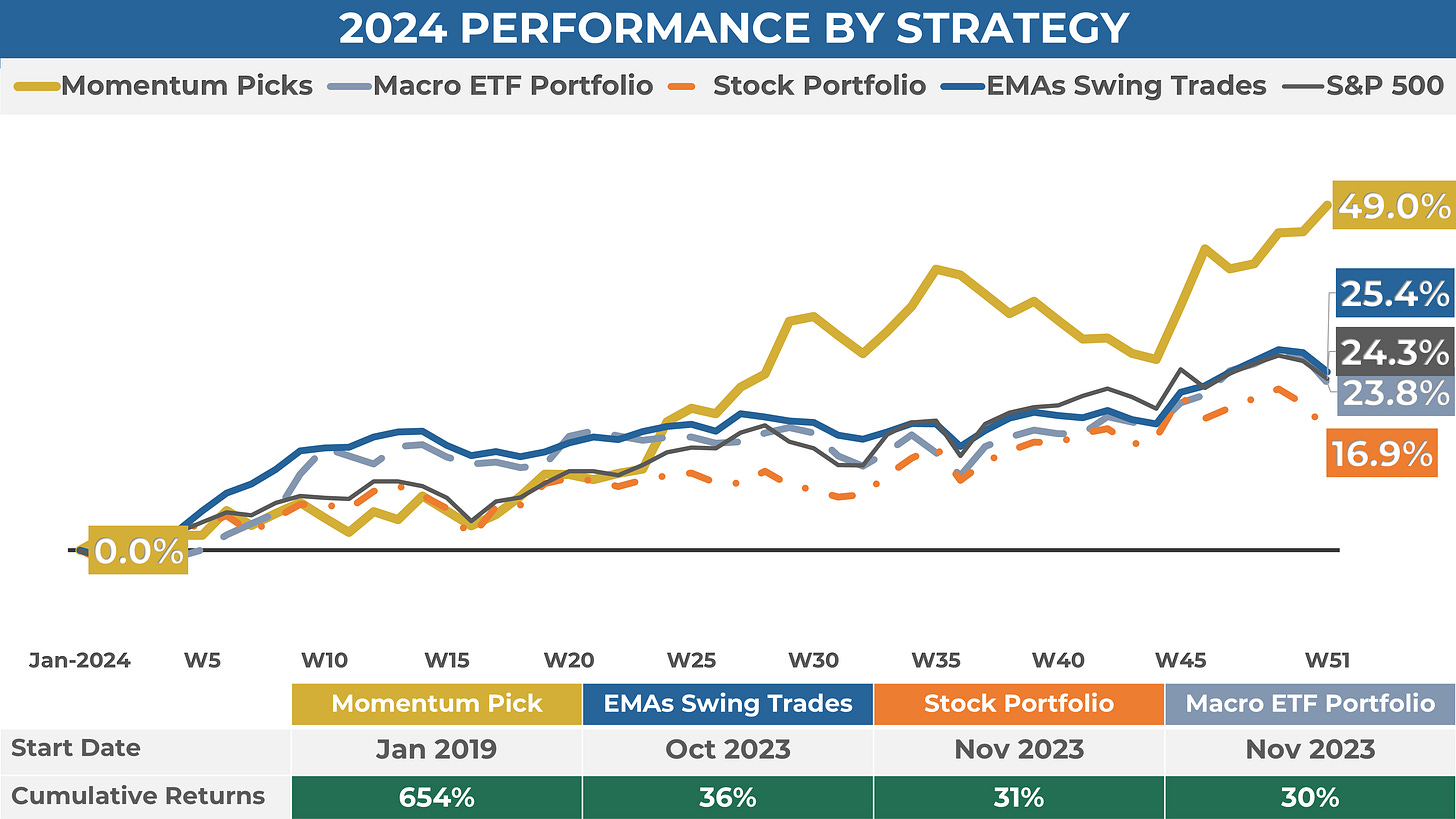

Since 2019, my stock picks have consistently generated strong returns, both in absolute terms and compared to the S&P 500 index. The cumulative return on my weekly momentum picks has been +654% since 2019 (when traded with stop-loss), outperforming the S&P 500 by 4x.

My stock pick was up 2.6% last week, bringing my 2024 performance to 49%.

My Momentum Pick for This Week

My stock pick for week #52 of 2024 is $AAPL (Apple Inc). The stock has risen 11% in the past month and 12% in the past quarter and is now trading less than 1% from its 52-week high. That makes $AAPL the stock with the best momentum profile on my watchlist.

I use a 2% stop-loss and a 6% profit target. Stop-losses are critical elements of any trading plan, particularly in periods of market volatility. I use stop-losses as price levels of interest to manage my positions, but I don’t set them up as automated orders. As a principle, I never sell on Mondays (unless profit target is hit) to give the trade a chance to work out.

Confidence Level: Medium

Momentum Conditions: Mixed | Algo Score: 94

The confidence level is a qualitative assessment based on my experience trading these stock picks. Best-performing picks typically involve 1) supportive short-term market conditions and 2) an algo score below 94, meaning the stock has room to run further.

Keep reading with a 7-day free trial

Subscribe to My Weekly Stock to keep reading this post and get 7 days of free access to the full post archives.