Weekly Trading Update #58 (Feb 10, 2025)

Momentum-driven stock picks and swing trades, powered by my proprietary research.

Dear readers,

Welcome back to My Weekly Stock, where in-depth market analysis meets proven momentum-based trading strategies. My mission? To help you win in the markets with unbiased, data-driven insights you can act on.

As we head into a new week, it means it's time for my Weekly Trading Update! In this post, I'll cover my two short-term trading strategies: Weekly Momentum Pick and Swing Trade Portfolio. Stay tuned to learn about my approach, recent moves (or planned ones), and how my strategies have performed.

If you want the full experience, consider upgrading your subscription. As a paid subscriber, you'll gain exclusive access to my 3 winning portfolios—and so much more: a clear investing framework, momentum-based analysis, and live portfolio updates

Plus, as a token of my appreciation, your first month is FREE. So, if you're ready to give it a try—or simply want to support my work—this is your chance!

Let's dive in!

SUMMARY

Weekly Momentum Pick (my short-term tactical play):

$JPM (JPMorgan Chase & Co) is my stock pick for this week, a leading company within the Financial sector, trading 1% from its 1-year high.

Last week’s pick delivered a 6.0% return, bringing my 2025 performance to +8%.

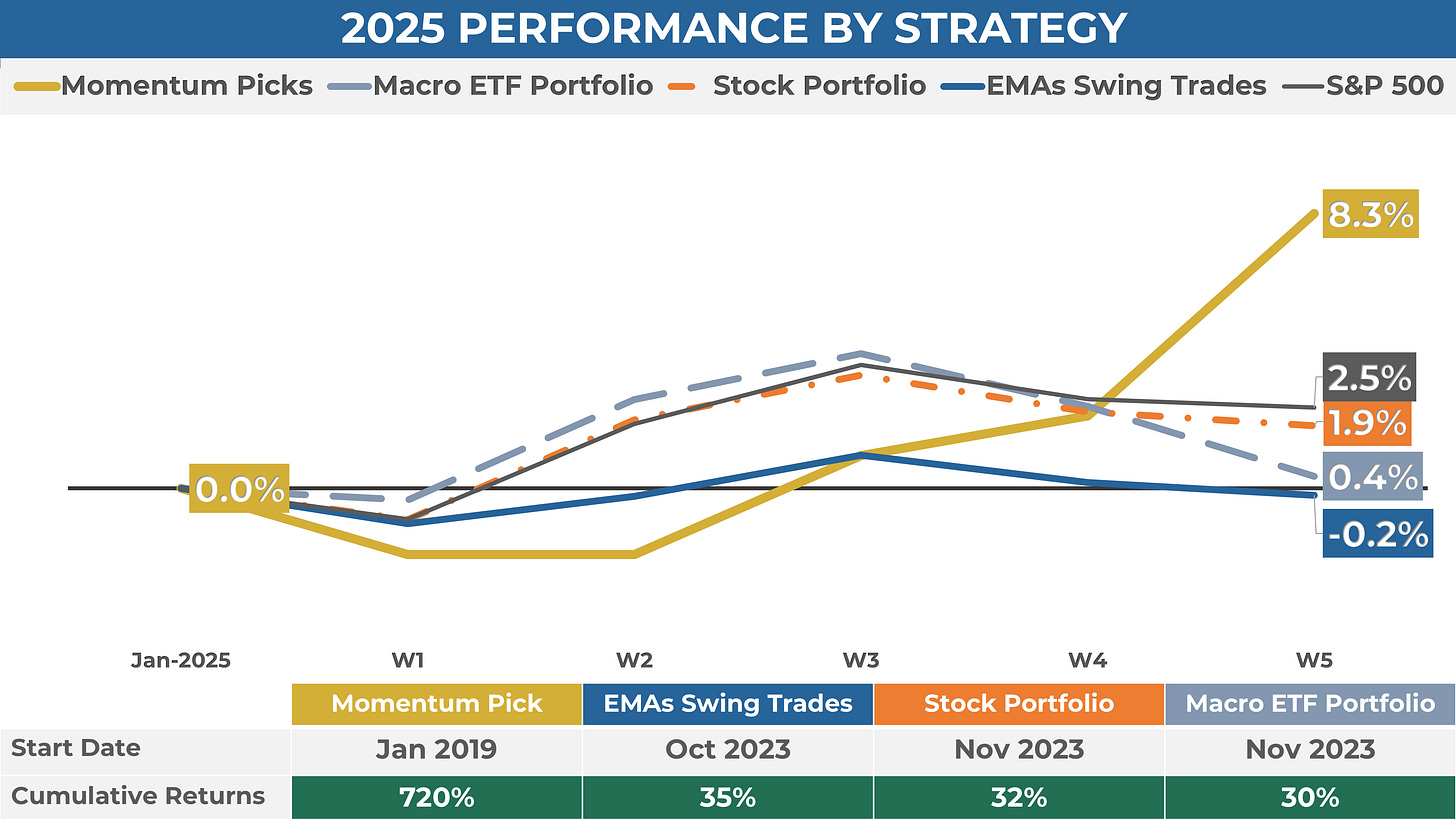

Since 2019, my momentum picks have achieved a 62% hit rate and returned 720%—outperforming the S&P 500 by 5x.

Swing Trade Portfolio (my comprehensive mid-term strategy):

Last week, I exited 3 positions and initiated 0 new ones. For the week ahead, I’m planning 2 transactions.

The portfolio is currently allocated as follows: 18% in Growth, 44% in Cyclical, 25% in Defensive, and 13% in Cash. Last week, I reduced my exposure in the growth segment.

I own 19 positions, with 13 currently in profit. The top performers are Amazon ($AMZN, +27%) and Meta Platforms (META, +22%).

Since its inception in October 2023, my Swing Trade Portfolio has returned 35%.

Trading Week Reflection:

Another wild week in the markets, starting with a sharp Monday dip, followed by a steady midweek recovery, and ending with a weak close on Friday. This choppy environment isn't ideal for a swing trader like me. There's a lot of divergence across positions—some have worked exceptionally well and are already approaching my first profit targets. In contrast, others have failed painfully, triggering breakout entries, only to pull back sharply. It is the hardest part of momentum-based swing trading—when setups lack follow-through. However, discipline is key: managing downside risk and efficiently reallocating cash to the most promising opportunities is the way to go. And yes, this sometimes means frustrating back-and-forth trades, even "buying high and selling low" occasionally. However, over time, catching the main trend move will more than make up for it.

The portfolio remains nearly fully invested, so I will focus on position management for the week ahead, exiting failed breakouts and taking profits whenever possible. More than ever, risk management is essential, as we're at the mercy of bearish headlines. And with a packed economic calendar next week, starting with the CPI report, volatility will likely stay high. Trade safely!

1. WEEKLY MOMENTUM PICK

Approach

I use a proprietary algorithm to evaluate momentum indicators for each company on my watchlist, including the 1-month and 3-month returns and the performance relative to their 52-week high and low. Each stock is then ranked based on these indicators, with a score assigned from highest to lowest. The stock with the highest average score becomes my pick for the week.

My trading plan is straightforward: I buy the stock pick at the market open on Monday and sell it by Friday's close. This strategy focuses on the 30 stocks in the Dow Jones (plus Alphabet). As the algorithm rewards consistent winners, it is not uncommon for the same stock to be selected for multiple weeks in a row.

Performance

Since 2019, my stock picks have delivered consistently strong returns, significantly outperforming the S&P 500. The cumulative return on my weekly momentum picks stands at +720% (when traded with a stop-loss), surpassing the S&P 500 by 5x.

Last week, my stock pick returned 6.0%, bringing my 2025 performance to 8%.

Momentum Pick of the Week

My stock pick for week #6 of 2025 is $JPM (JPMorgan Chase & Co). The stock has gained 13% in the past month and 25% in the past quarter, currently trading 1% from its 52-week high. That makes $JPM the stock with the best momentum profile on my watchlist.

The entry price is always Monday's market open. I then calculate a 6% profit target and a 2% stop-loss limit based on the entry price. These levels are used as performance benchmarks. If the price breaches the stop-loss or profit target during the week, I assume an exit at that level. I don't sell on Monday if the stop-loss is hit, but I sell if the profit target is reached. I exit at Friday's close if none of these conditions are met.

While my personal entry and exit prices may vary slightly— for better or worse, the simplified approach makes tracking performance clearer and easier to replicate.

Confidence Level: Medium

Long-Term Trend: Positive

Short-term Momentum: Mixed

Algo Score: 96

The confidence level reflects my qualitative assessment based on my experience with these stock picks. The best-performing picks often exhibit two key traits:

Supportive broader market conditions.

An algo score below 94, indicating the stock still has room to run.

Keep reading with a 7-day free trial

Subscribe to My Weekly Stock to keep reading this post and get 7 days of free access to the full post archives.