My stock pick for week #3 of 2023 (Jan. 16-20)

The stocks you need to watch this week, hand-picked by my proprietary algorithm

Hello fellow investors!

It's Monday, and that means it's time for my weekly stock pick!

My stock selections are derived from my proprietary algorithm that analyzes a range of technical and momentum indicators to identify the companies the most likely to outperform short-term. This strategy has a proven track record of success, with an average return of 8% in 2023 and 386% since 2019.

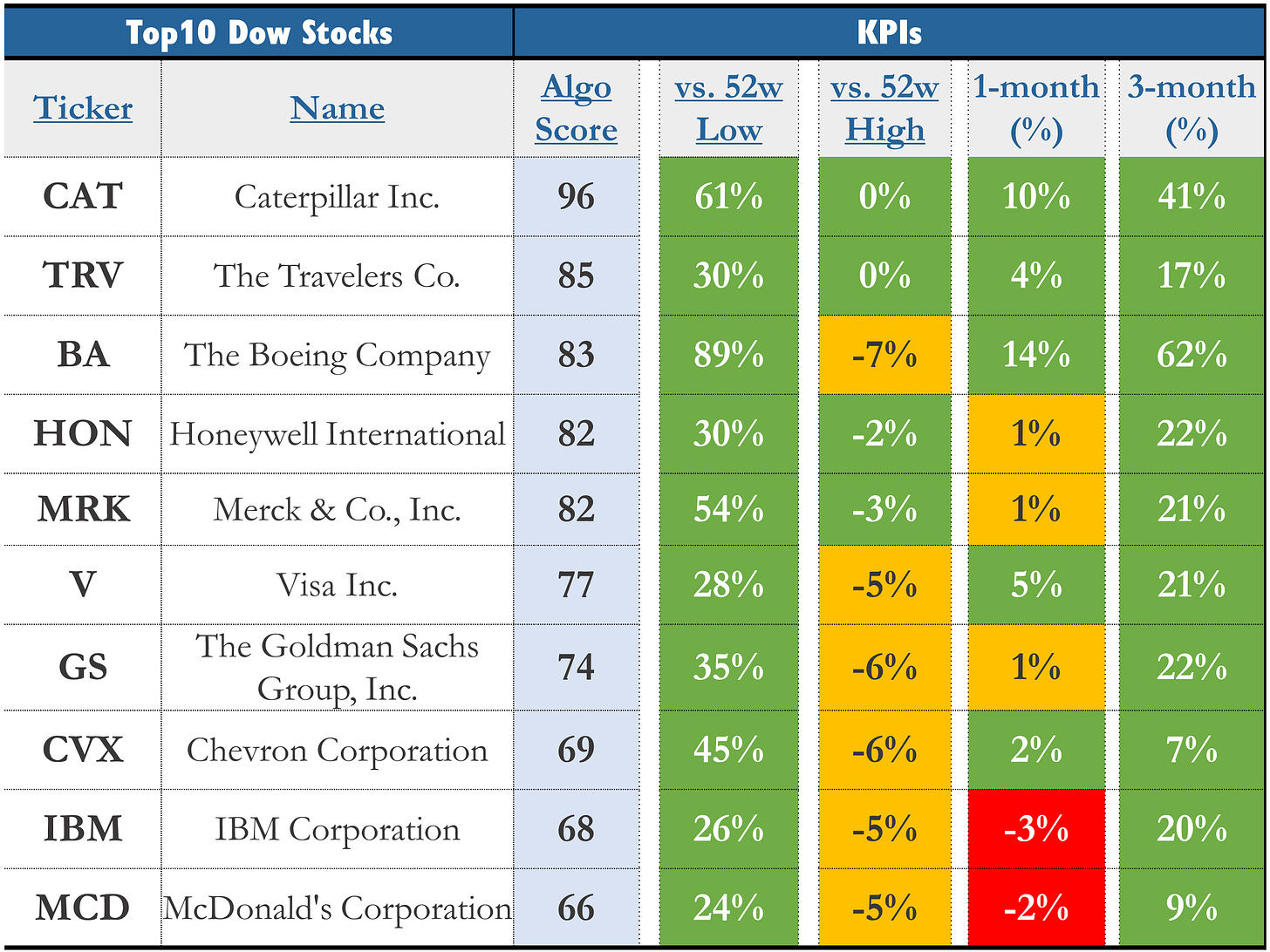

This week, my algorithm has identified Caterpillar (CAT) as a top pick, a leading company within the Industrials sector with strong momentum and trading less than 1% from its 52-week high.

I hope you enjoy this week's edition and find it helpful. If you like what you see, please share it with your network on social media and, if you haven't already, subscribe to our email updates.

Stay tuned to learn more about how my algorithm works and my performance. And, as always, happy investing!

METHODOLOGY

My trading methodology is based on a momentum strategy validated through extensive research and back-testing. I use a proprietary algorithm that runs over the weekend to identify stocks showing strong momentum and likely to continue outperforming.

The algorithm collects various momentum indicators for each stock in my watchlist, including performance over the last 1 and 3 months and the current price compared to the 52-week high and low. I then rank the stocks based on each indicator, assigning a score from highest to lowest. For example, if I have 30 stocks on my watchlist, the stock with the best 1-month return would receive a score of 30, while the second-best would receive a score of 29, and so on. I then calculate the average score of all the indicators using a proprietary weighting system, and the stock with the highest average score becomes my pick for the week.

From there, I developed a simple trading principle: I buy one stock on Monday at the market open and sell it by Friday's close. I focus on the 30 stocks from the Dow Jones (+ Alphabet). It is common for the same stock to be selected by the algorithm for several weeks in a row, as the strategy favors winners, and I have a relatively small stock universe.

PERFORMANCE

I evaluate my weekly performance by looking at the difference between the stock price at the start of the week (Monday's opening) and the end of the week (Friday's closing). I then compound the weekly results to determine my cumulative and yearly performance.

Since 2019, my stock picks have consistently generated strong returns, both in absolute terms and compared to the S&P 500 index. The cumulative return on my weekly stock picks has been 386% since 2019, outperforming the S&P 500 by a factor of 5.

Last week, my stock pick increased by 3.8%, bringing my performance in 2023 to a positive 8%.

MY STOCK PICK

My stock pick for week #3 of 2023 is Caterpillar (CAT). The stock is up 10% in the past month, 41% in the past quarter, and is trading less than 1% from its 52-week high. That makes CAT the stock with the best momentum profile in the Dow Jones.

ADDITIONAL PICKS (FOR RESEARCH PURPOSES ONLY)

I am conducting additional research to improve my algorithm by testing it on different stock universes or using different positions (long or short). I have decided to share my selections to document and track the performance publicly. Here are the three strategies and their corresponding picks for next week:

LONG - S&P 500 sector ETF: Industrials (XLI)

LONG - US stocks with market cap >$150bn: Oracle (ORCL)

SHORT - US stocks with market cap >$150bn: Tesla (TSLA)

These picks are based on my algorithm, only enhanced with moving averages on the weekly and 1-hour charts. The principles for trading are also consistent: buy at the market's opening on Monday and sell at the closing on Friday.

CONCLUSION

To wrap up, my stock pick for the coming week is Caterpillar (CAT). While it's impossible to predict market movements with certainty, Caterpillar has the best momentum profile in the Dow Jones, and I encourage my readers to research the stock further.

Remember to subscribe to this newsletter to receive my future stock picks and updates on my performance.

Thank you for reading about my weekly stock pick, and I hope you found it helpful. Please consider sharing this post with your friends and followers if you did.

If you have any questions or feedback, please don't hesitate to reach out by email or in the comment section. Your support helps me to continue creating high-quality content and is greatly appreciated.

As always, happy investing, and I look forward to sharing my next pick with you next Monday!

My Weekly Stock

DISCLAIMER

Please be aware that I currently do not have a position in the stocks mentioned in this article, but I may initiate a position within the next 24 hours. This disclosure is made for transparency purposes and should not be taken as a recommendation to buy or sell any securities.

The information provided in this newsletter is for informational purposes only and should not be taken as financial advice. Any investments or decisions made based on the information provided in this newsletter are the reader's sole responsibility. We recommend that readers conduct their own research and consult a qualified financial professional before making investment decisions. The author does not assume any responsibility for any losses or damages arising from using the information provided in this newsletter.